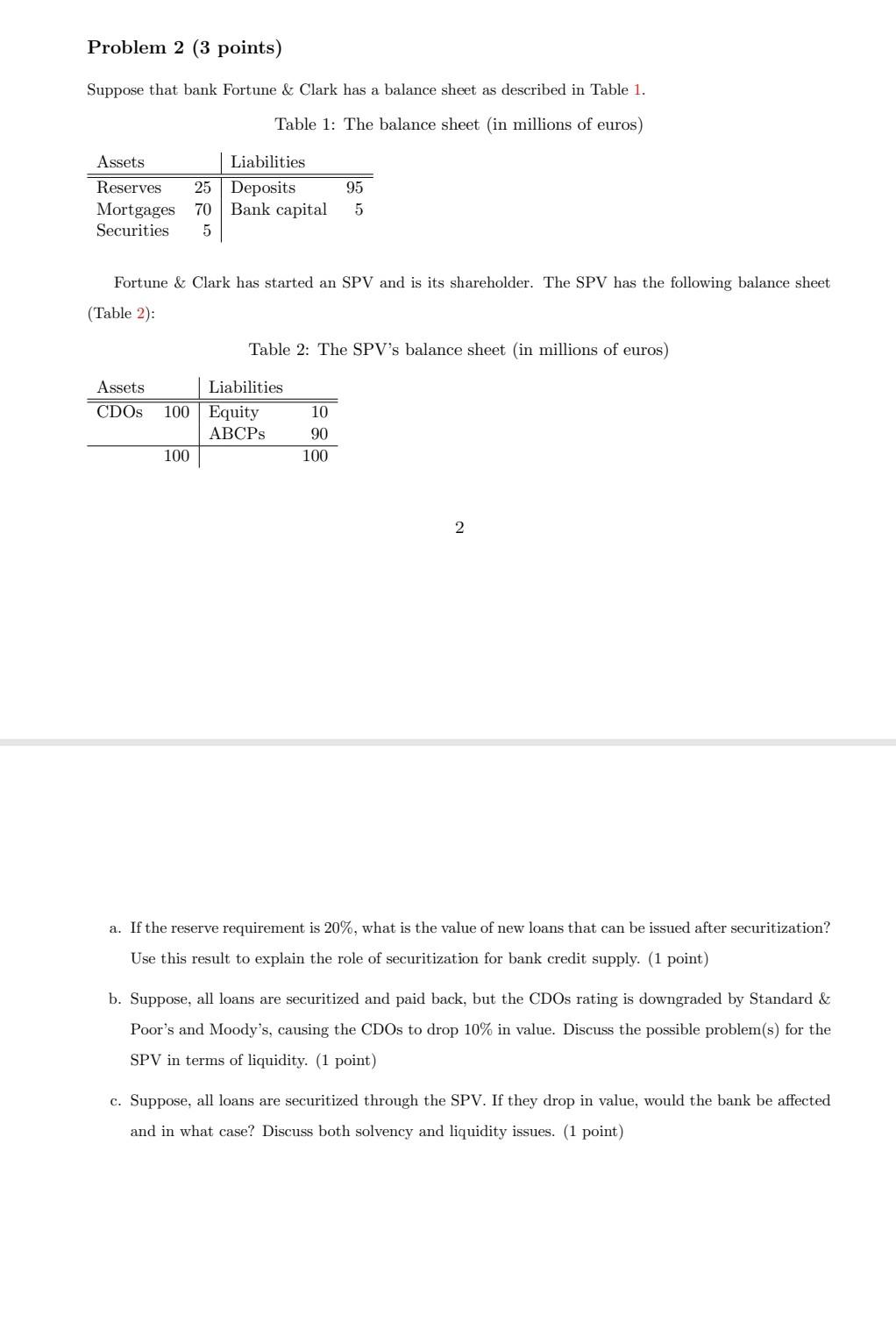

Question: Problem 2 (3 points) Suppose that bank Fortune & Clark has a balance sheet as described in Table 1. Table 1: The balance sheet in

Problem 2 (3 points) Suppose that bank Fortune & Clark has a balance sheet as described in Table 1. Table 1: The balance sheet in millions of euros) Assets Liabilities Reserves 25 Deposits Mortgages 70 Bank capital Securities 5 95 5 Fortune & Clark has started an SPV and is its shareholder. The SPV has the following balance sheet (Table 2): Table 2: The SPV's balance sheet (in millions of euros) Assets CDOS 100 Liabilities Equity ABCPs 10 90 100 100 2 a. If the reserve requirement is 20%, what the value of new loans that can be issued after securitization? Use this result to explain the role of securitization for bank credit supply. (1 point) b. Suppose, all loans are securitized and paid back, but the CDOs rating is downgraded by Standard & Poor's and Moody's, causing the CDOs to drop 10% in value. Discuss the possible problem(s) for the SPV in terms of liquidity. (1 point) c. Suppose, all loans are securitized through the SPV. If they drop in value, would the bank be affected and in what case? Discuss both solvency and liquidity issues. (1 point) Problem 2 (3 points) Suppose that bank Fortune & Clark has a balance sheet as described in Table 1. Table 1: The balance sheet in millions of euros) Assets Liabilities Reserves 25 Deposits Mortgages 70 Bank capital Securities 5 95 5 Fortune & Clark has started an SPV and is its shareholder. The SPV has the following balance sheet (Table 2): Table 2: The SPV's balance sheet (in millions of euros) Assets CDOS 100 Liabilities Equity ABCPs 10 90 100 100 2 a. If the reserve requirement is 20%, what the value of new loans that can be issued after securitization? Use this result to explain the role of securitization for bank credit supply. (1 point) b. Suppose, all loans are securitized and paid back, but the CDOs rating is downgraded by Standard & Poor's and Moody's, causing the CDOs to drop 10% in value. Discuss the possible problem(s) for the SPV in terms of liquidity. (1 point) c. Suppose, all loans are securitized through the SPV. If they drop in value, would the bank be affected and in what case? Discuss both solvency and liquidity issues. (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts