Question: Problem 2. (3 pts) Fast as Lightning is an oil change service drive-through that charges each customer $24.00 for an oil and filter change service.

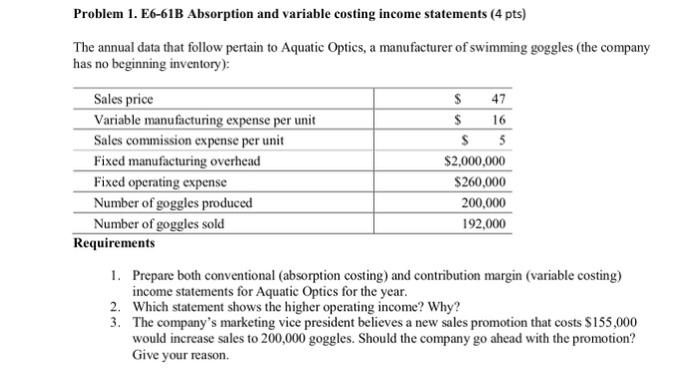

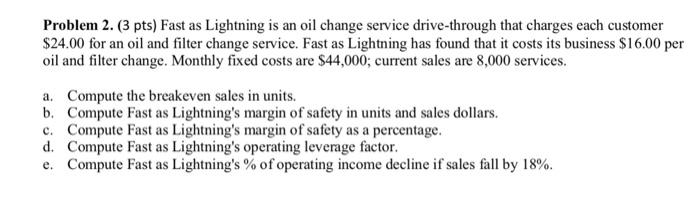

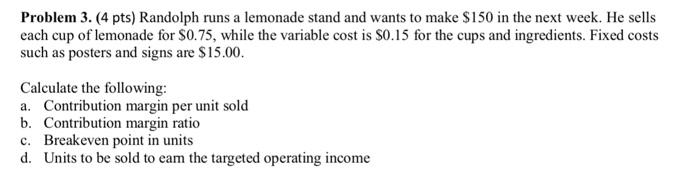

Problem 2. (3 pts) Fast as Lightning is an oil change service drive-through that charges each customer $24.00 for an oil and filter change service. Fast as Lightning has found that it costs its business $16.00 per oil and filter change. Monthly fixed costs are $44,000; current sales are 8,000 services. a. Compute the breakeven sales in units. b. Compute Fast as Lightning's margin of safety in units and sales dollars. c. Compute Fast as Lightning's margin of safety as a percentage. d. Compute Fast as Lightning's operating leverage factor. e. Compute Fast as Lightning's \% of operating income decline if sales fall by 18%. Problem 1. E6-61B Absorption and variable costing income statements (4 pts) The annual data that follow pertain to Aquatic Optics, a manufacturer of swimming goggles (the company has no beginning inventory): 1. Prepare both conventional (absorption costing) and contribution margin (variable costing) income statements for Aquatic Optics for the year. 2. Which statement shows the higher operating income? Why? 3. The company's marketing vice president believes a new sales promotion that costs $155,000 would increase sales to 200,000 goggles. Should the company go ahead with the promotion? Give your reason. Problem 3. (4 pts) Randolph runs a lemonade stand and wants to make $150 in the next week. He sells each cup of lemonade for $0.75, while the variable cost is $0.15 for the cups and ingredients. Fixed costs such as posters and signs are $15.00. Calculate the following: a. Contribution margin per unit sold b. Contribution margin ratio c. Breakeven point in units d. Units to be sold to eam the targeted operating income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts