Question: Problem 2 (30 marks): The most recent financial statements for Fleury, Inc., follow. Sales for 2010 are projected to grow by 18 percent. Interest expense

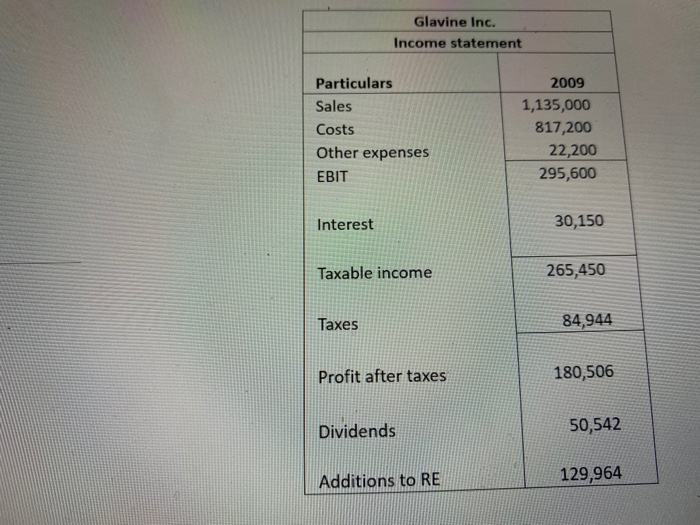

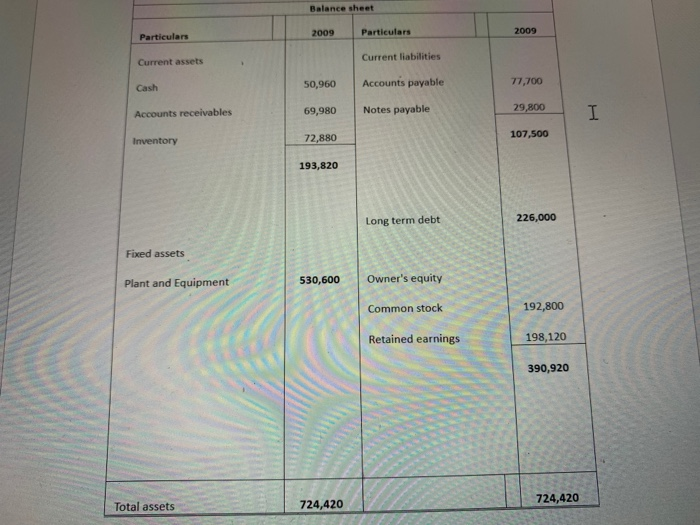

Problem 2 (30 marks): The most recent financial statements for Fleury, Inc., follow. Sales for 2010 are projected to grow by 18 percent. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. If the firm is operating at full capacity and no new debt or equity is issued, what external financing is needed to support the 18 percent growth rate in sales? Glavine Inc. Income statement Particulars Sales Costs Other expenses EBIT 2009 1,135,000 817,200 22,200 295,600 Interest 30,150 Taxable income 265,450 Taxes 84,944 Profit after taxes 180,506 Dividends 50,542 Additions to RE 129,964 Balance sheet Particulars 2009 Particulars 2009 Current assets Current liabilities Cash 50,960 77,700 Accounts payable 69,980 Accounts receivables 29,800 Notes payable I Inventory 72,880 107,500 193,820 Long term debt 226,000 Fixed assets Plant and Equipment 530,600 Owner's equity Common stock 192,800 Retained earnings 198,120 390,920 724,420 Total assets 724,420

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts