Question: Problem 2: (30 points) On June 1, 2020, White Snow Corp. contracted with Black Construction to have a new building constructed for $4,000,000 on land

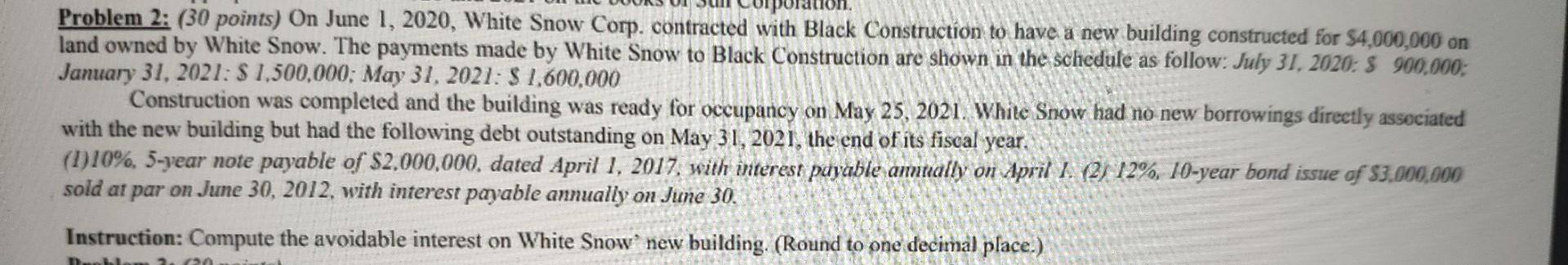

Problem 2: (30 points) On June 1, 2020, White Snow Corp. contracted with Black Construction to have a new building constructed for $4,000,000 on land owned by White Snow. The payments made by White Snow to Black Construction are shown in the schedule as follow: July 31, 2020: $ 900,000: January 31, 2021: $ 1.500,000: May 31, 2021: $ 1,600,000 Construction was completed and the building was ready for occupancy on May 25, 2021. White Snow had no new borrowings directly associated with the new building but had the following debt outstanding on May 31, 2021, the end of its fiscal year. (1) 10%, 5-year note payable of $2,000,000, dated April 1, 2017, with interest payable annually on April 1. (2) 12%, 10-year bond issue of $3,000,000 sold at par on June 30, 2012, with interest payable annually on June 30. Instruction: Compute the avoidable interest on White Snow new building. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts