Question: Problem 2 ( 30 points): Roche Brothers is considering a capacity expansion of its supermarket. The landowner will build the addition to suit in return

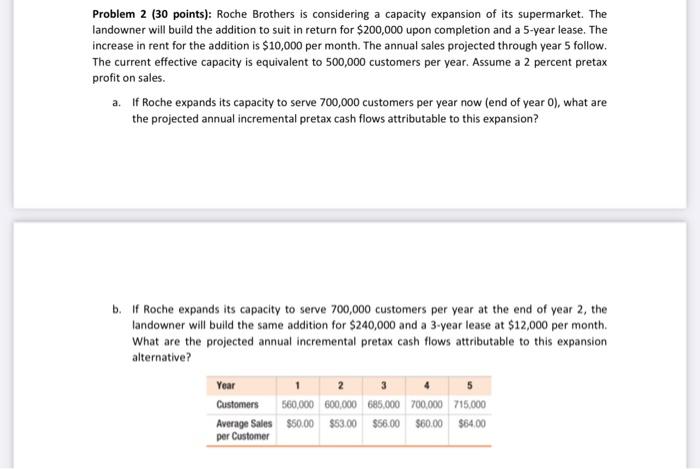

Problem 2 ( 30 points): Roche Brothers is considering a capacity expansion of its supermarket. The landowner will build the addition to suit in return for $200,000 upon completion and a 5-year lease. The increase in rent for the addition is $10,000 per month. The annual sales projected through year 5 follow. The current effective capacity is equivalent to 500,000 customers per year. Assume a 2 percent pretax profit on sales. a. If Roche expands its capacity to serve 700,000 customers per year now (end of year 0 ), what are the projected annual incremental pretax cash flows attributable to this expansion? b. If Roche expands its capacity to serve 700,000 customers per year at the end of year 2 , the landowner will build the same addition for $240,000 and a 3-year lease at $12,000 per month. What are the projected annual incremental pretax cash flows attributable to this expansion alternative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts