Question: Problem 2 (38 points) Use the following information to answer the questions below .At the beginning of the year, TDF Enterprises had an Accounts Receivable

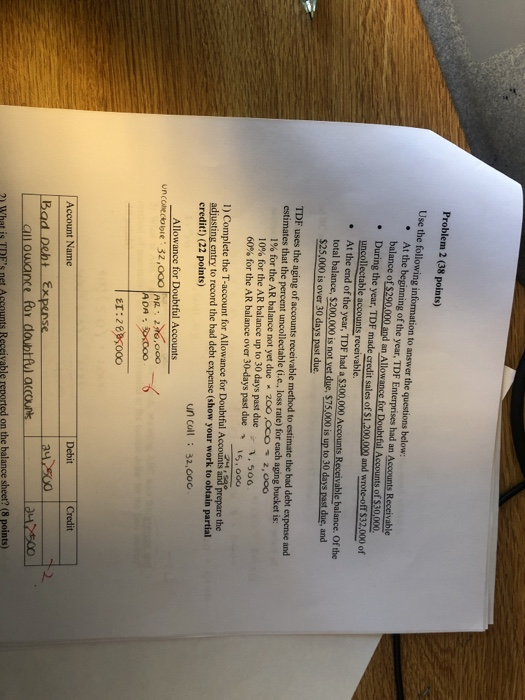

Problem 2 (38 points) Use the following information to answer the questions below .At the beginning of the year, TDF Enterprises had an Accounts Receivable . During the year, TDF made credit sales of $1.200,000 and wrote-off $32,000 of . At the end of the year, TDF had a $300,000 balance of $290. uncollectable accounts receivable. total balance, $200,000 is not yet due, $75,000 is up to 30 days past due, and an Allowance for Doubtful Accounts of $30,000 Receivable balance. Of the $25,000 is over 30 days past due. TDF uses the aging of accounts receivable method to estimate the bad debt expense and estimates that the percent uncollectable (i.e., loss rate) for each aging bucket its 1% for the AR balance not yet due 200 ,OCo 10% for the AR balance up to 30 days past due r 2,000 1 , 500 60% for the AR balance over 30-days past due 15, 000 1) Complete the T-account for Allowance for Doubtful Accounts and prepare the adjusting entry to record the bad debt expense (show your work to obtain partial credit!) (22 points) un coll: 32,000 Allowance for Doubtful Accounts uncceecebie. 32,060 |AR .. 2,70,000 Credit Account Name eht Expense all owance for doubte) acounk 2) What is TDE's net Accounts Receivable reported on the balance sheet? (8 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts