Question: Problem 2 - 4 1 ( LO 2 - 5 ) Determine the average tax rate and the marginal tax rate for each of the

Problem LO

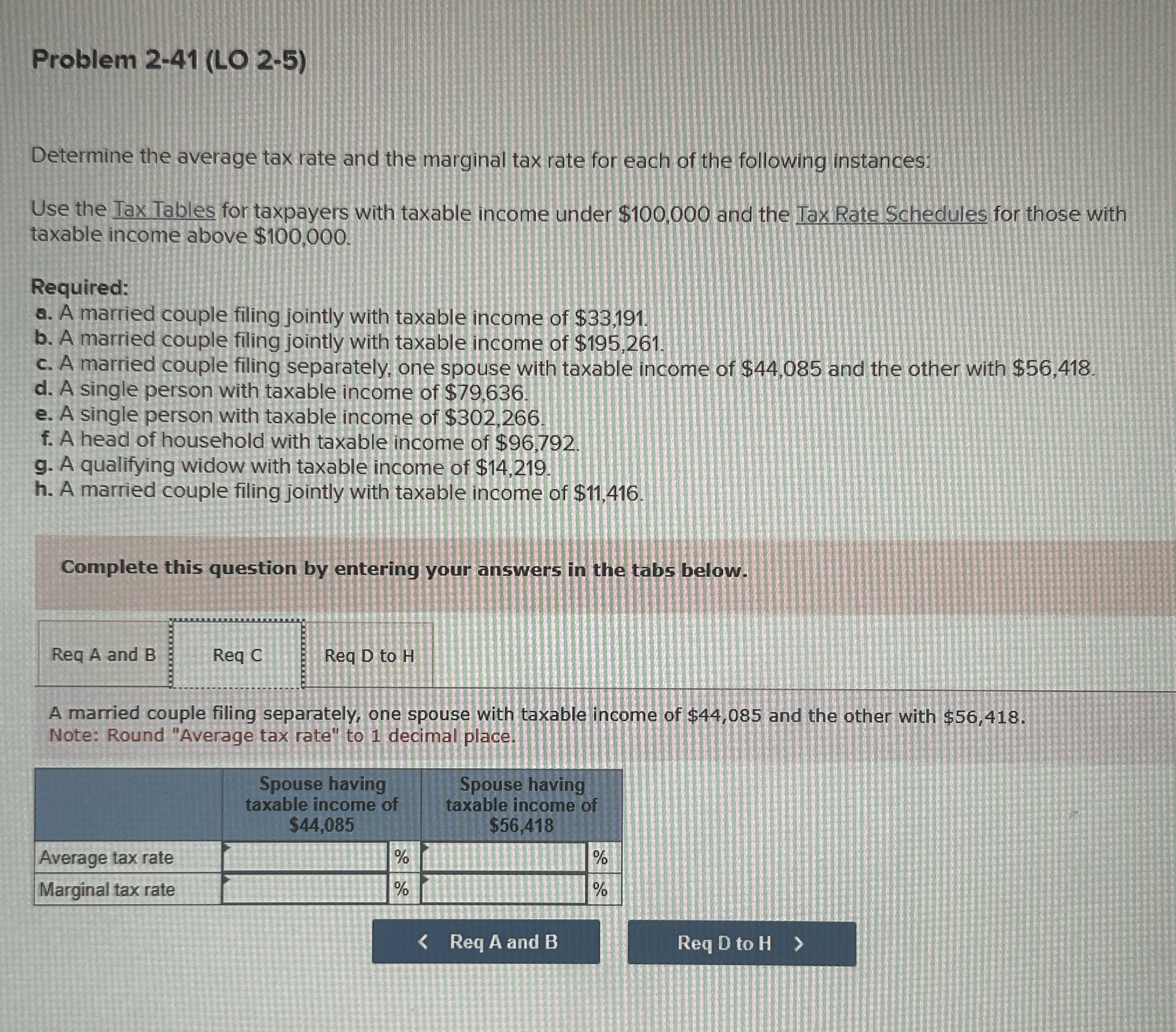

Determine the average tax rate and the marginal tax rate for each of the following instances:

Use the Tax Tables for taxpayers with taxable income under $ and the Tax Rate Schedules for those with taxable income above $

Required:

a A married couple filing jointly with taxable income of $

b A married couple filing jointly with taxable income of $

c A married couple filing separately, one spouse with taxable income of $ and the other with $

d A single person with taxable income of $

e A single person with taxable income of $

f A head of household with taxable income of $

g A qualifying widow with taxable income of $

h A married couple filing jointly with taxable income of $

Complete this question by entering your answers in the tabs below.

Req A and B Req D to H

A married couple filing separately, one spouse with taxable income of $ and the other with $

Note: Round "Average tax rate" to decimal place.

tableSpouse having taxable income of $Spouse having taxable income of $Average tax rate,Marginal tax rate,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock