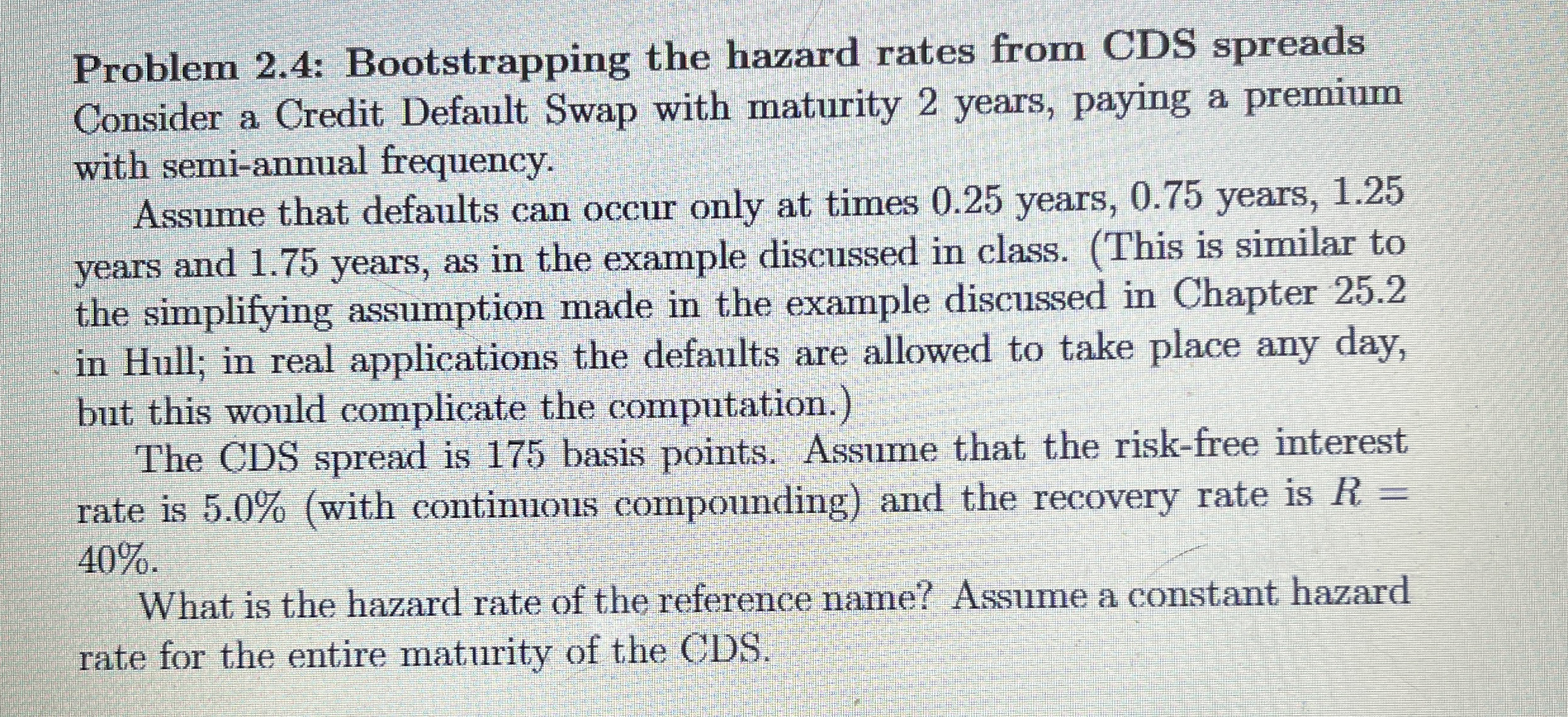

Question: Problem 2 . 4 : Bootstrapping the hazard rates from CDS spreads Consider a Credit Default Swap with maturity 2 years, paying a premium with

Problem : Bootstrapping the hazard rates from CDS spreads Consider a Credit Default Swap with maturity years, paying a premium with semiannual frequency.

Assume that defaults can occur only at times years, years, years and years, as in the example discussed in class. This is similar to the simplifying assumption made in the example discussed in Chapter in Hull; in real applications the defaults are allowed to take place any day, but this would complicate the computation.

The CDS spread is basis points. Assume that the riskfree interest rate is with continuous compounding and the recovery rate is

What is the hazard rate of the reference name? Assume a constant hazard rate for the entire maturity of the CDS

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock