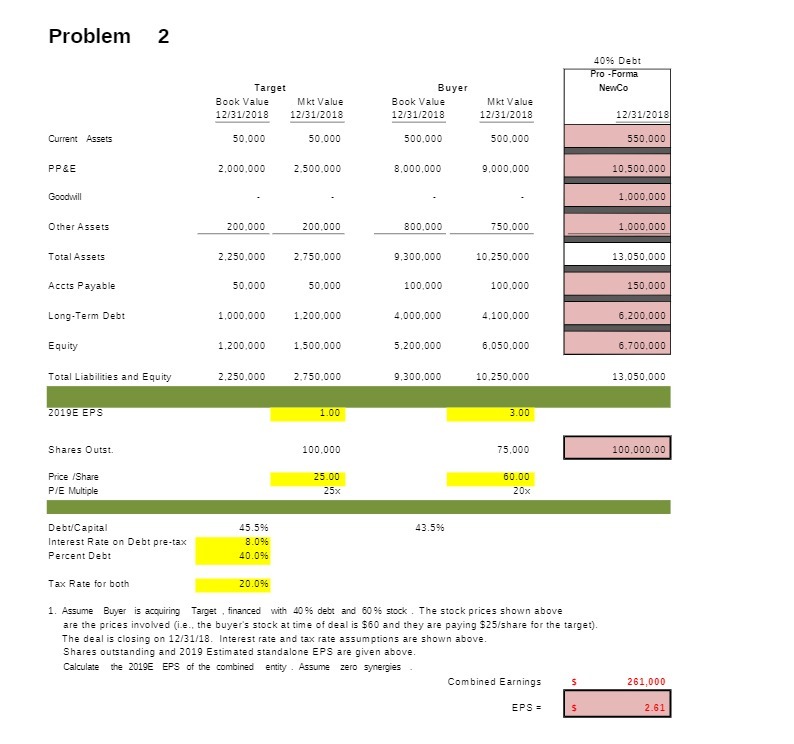

Question: Problem 2 40% Debt Pro - Forma Target Buyer NewCo Book Value Mkt Value Book Value Mkt Value 12/31/2018 12/31/2018 12/31/2018 12/31/2018 12/31/2018 Current Assets

Problem 2 40% Debt Pro - Forma Target Buyer NewCo Book Value Mkt Value Book Value Mkt Value 12/31/2018 12/31/2018 12/31/2018 12/31/2018 12/31/2018 Current Assets 50.000 50.000 500.000 500.000 550.000 PP&E 2.000.000 2.500.000 8,000,000 9.000,000 10.500,000 Goodwill 1.000,000 Other Assets 200.000 200.000 800,000 750,000 1.000,000 Total Assets 2.250.000 2.750.000 9.300,000 10,250.000 13.050,000 Accts Payable 50.000 50.000 100,000 100.000 150,000 Long-Term Debt 1,000.000 1.200.000 4,000,000 4,100,000 6.200.000 Equity 1,200.000 1.500.000 5,200,000 6.050,000 6.700.000 Total Liabilities and Equity 2,250.000 2.750.000 .300,000 10,250,000 13.050,000 20196 EPS 1.00 3.00 Shares Outst 100,000 75,000 100,000.00 Price /Share 25.00 60.00 P/E Multiple 25x 20x Debt/Capital 45.5% 43.5% Interest Rate on Debt pre-tax 8.0% Percent Debt 40.096 Tax Rate for both 20.0% 1. Assume Buyer is acquiring Target , financed with 409% debt and 60 9% stock . The stock prices shown above are the prices involved (i.e., the buyer's stock at time of deal is $60 and they are paying $25/share for the target). The deal is closing on 12/31/18. Interest rate and tax rate assumptions are shown above. Shares outstanding and 2019 Estimated standalone EPS are given above. Calculate the 20196 EPS of the combined entity . Assume zero synergies Combined Earnings 261,000 EPS = 2.61

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts