Question: Problem #2 (40 Points) Hillman Inc. is considering a proposal to invest $210,000 in new production equipment which will be depreciated on a straight-line basis

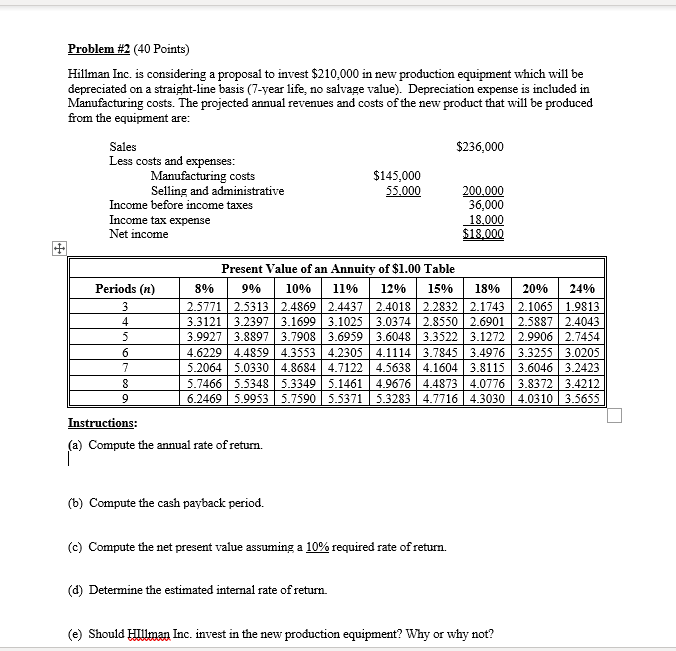

Problem #2 (40 Points) Hillman Inc. is considering a proposal to invest $210,000 in new production equipment which will be depreciated on a straight-line basis (7-year life, no salvage value). Depreciation expense is included in Manufacturing costs. The projected annual revenues and costs of the new product that will be produced from the equipment are: Sales $236,000 Less costs and expenses: Manufacturing costs $145,000 Selling and administrative 55,000 200,000 Income before income taxes 36,000 Income tax expense 18.000 Net income $18.000 Periods (n) Present Value of an Annuity of $1.00 Table 8% 9% 10% 11% 12% 15% 18% 20% 24% 2.5771 2.5313 2.4869 2.44372.4018 2.2832 2.1743 2.1065 1.9813 3.3121 3.2397 3.1699 3.1025 3.0374 2.8550 2.6901 2.5887 2.4043 3.99273.88973.7908 3.6959 3.6048 3.3522 3.1272 2.9906 2.7454 4.6229 4.48594.3553 4.2305 4.1114 3.7845 3.49763.3255 3.0205 | 5.20645.03304.86844.71224.56384.1604 3.8115 3.6046 3.2423 5.7466 5.5348 5.3349 5.1461 4.9676 4.4873 4.0776 3.8372 3.4212 6.2469 5.9953 5.7590 5.5371 5.3283 4.7716 4.3030 4.03103.5655 o Instructions: (a) Compute the annual rate of retum. (6) Compute the cash payback period. (c) Compute the net present value assuming a 10% required rate of return. (d) Determine the estimated internal rate of return. (e) Should Hillman Inc. invest in the new production equipment? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts