Question: Problem 2 5 - 2 4 ( LO . 6 ) The Open Museum is an exempt organization that operates a gift shop. The museum's

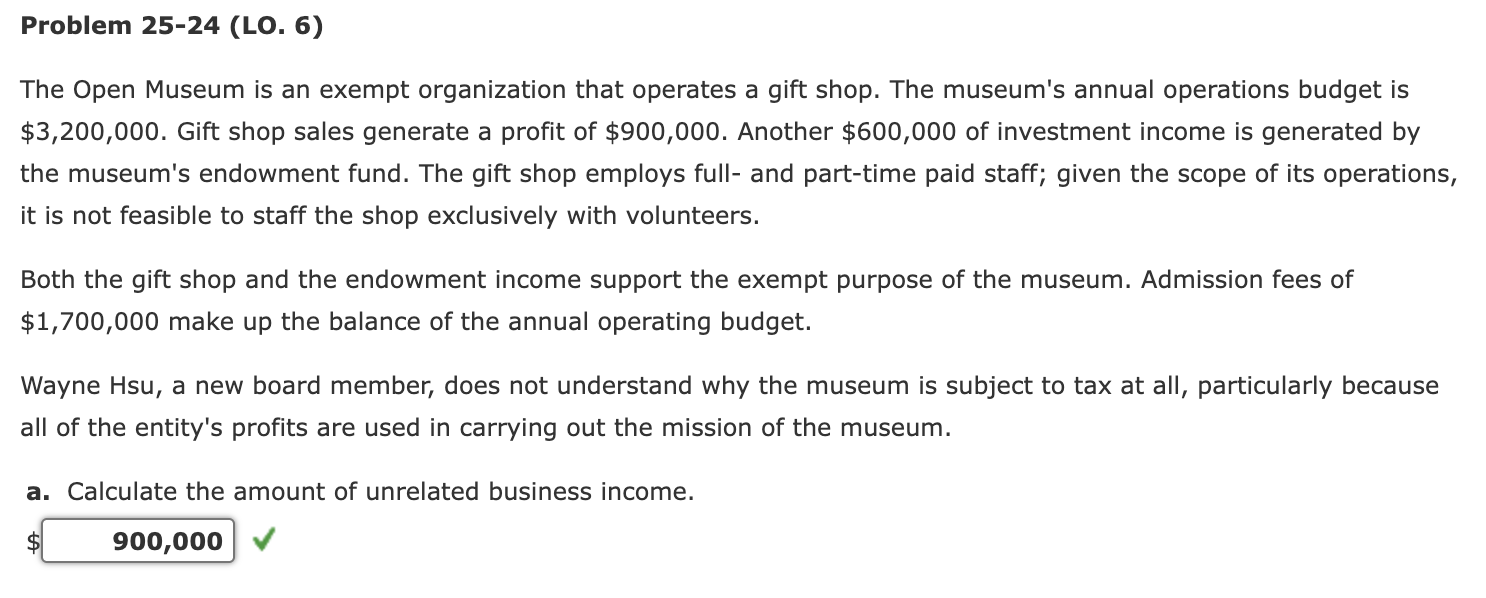

Problem LO The Open Museum is an exempt organization that operates a gift shop. The museum's annual operations budget is $ Gift shop sales generate a profit of $ Another $ of investment income is generated by the museum's endowment fund. The gift shop employs full and parttime paid staff; given the scope of its operations, it is not feasible to staff the shop exclusively with volunteers. Both the gift shop and the endowment income support the exempt purpose of the museum. Admission fees of $ make up the balance of the annual operating budget. Wayne Hsu, a new board member, does not understand why the museum is subject to tax at all, particularly because all of the entity's profits are used in carrying out the mission of the museum. a Calculate the amount of unrelated business income. February

Mr Wayne Hsu

Pine Avenue

Peoria, IL

Dear Mr Hsu:

I am responding to your inquiry regarding the taxexempt status of the Open Museum. The Open Museum generally is exempt from Federal income taxation under c of the Internal Revenue Code as a public charity. We were granted exempt status many years ago.

The gift shop is considered an unrelated trade or business checkmark checkmark even though all of its profits are used in carrying out the mission of the museum. Therefore, the profits of the gift shop are taxed at the Federal corporate income tax rate checkmark checkmark If we could staff the gift shop completely with volunteers, its profits

checkmark taxexempt. However, this is

checkmark for the scope of the gift shop's operations.

Except for profits from the gift shop, all of our income checkmark taxexempt. This includes $

X of our admission fees and $ X of endowment income.

If I can be of further assistance, please let me know before one of the board meetings.

Sincerely,

Jeff Waller, Treasurer

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock