Question: Problem 2 (5 points): Assume that forward rates for the next year are given by r(0.5)=7% and r(1)=6% and consider a 5% coupon bond maturing

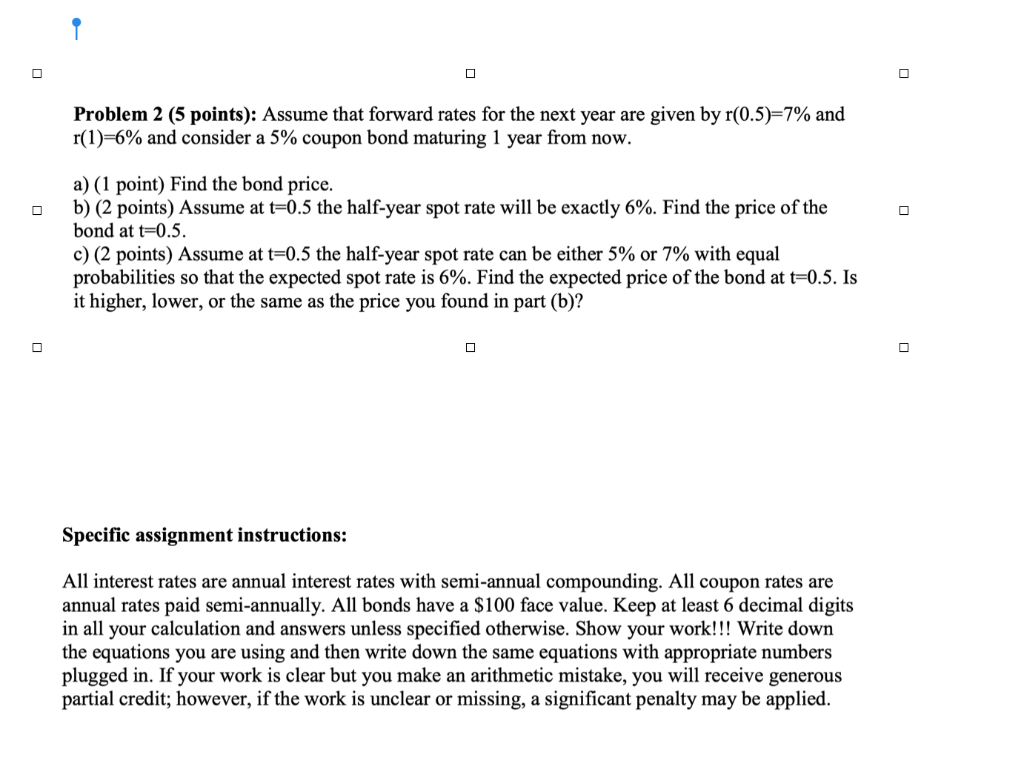

Problem 2 (5 points): Assume that forward rates for the next year are given by r(0.5)=7% and r(1)=6% and consider a 5% coupon bond maturing 1 year from now. a) (1 point) Find the bond price. b) (2 points) Assume at t=0.5 the half-year spot rate will be exactly 6%. Find the price of the bond at t=0.5. c) (2 points) Assume at t=0.5 the half-year spot rate can be either 5% or 7% with equal probabilities so that the expected spot rate is 6%. Find the expected price of the bond at t=0.5. Is it higher, lower, or the same as the price you found in part (b)? Specific assignment instructions: All interest rates are annual interest rates with semi-annual compounding. All coupon rates are annual rates paid semi-annually. All bonds have a $100 face value. Keep at least 6 decimal digits in all your calculation and answers unless specified otherwise. Show your work!!! Write down the equations you are using and then write down the same equations with appropriate numbers plugged in. If your work is clear but you make an arithmetic mistake, you will receive generous partial credit; however, if the work is unclear or missing, a significant penalty may be applied

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts