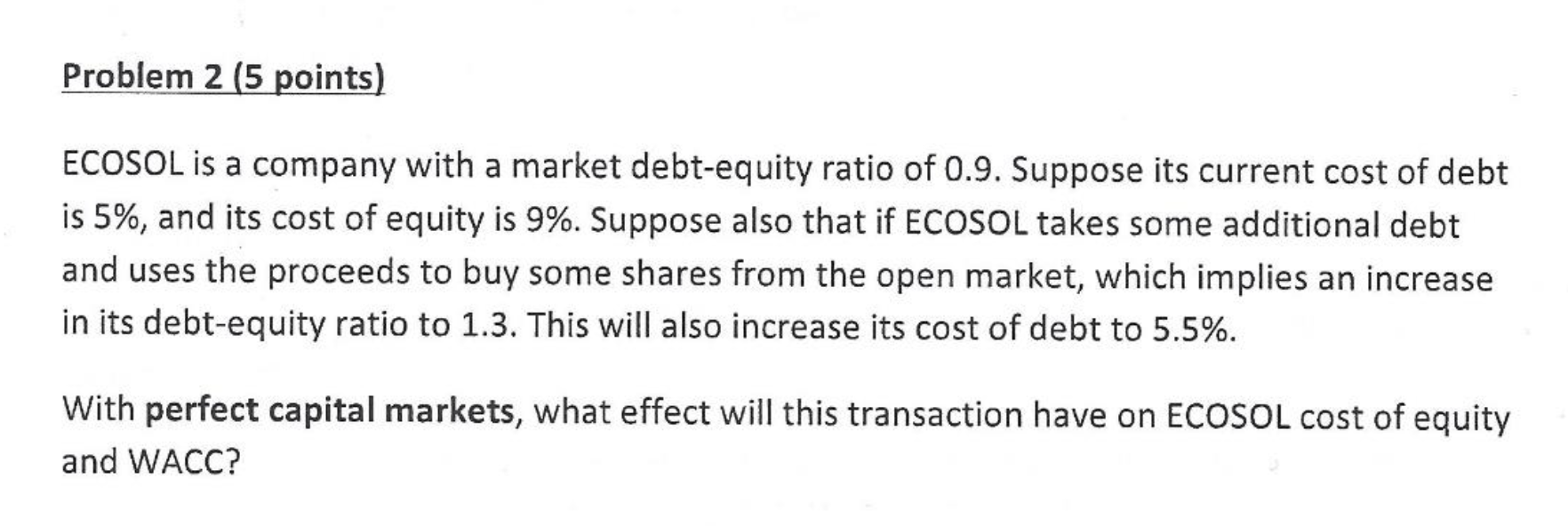

Question: Problem 2 ( 5 points ) ECOSOL is a company with a market debt - equity ratio of 0 . 9 . Suppose its current

Problem points

ECOSOL is a company with a market debtequity ratio of Suppose its current cost of debt is and its cost of equity is Suppose also that if ECOSOL takes some additional debt and uses the proceeds to buy some shares from the open market, which implies an increase in its debtequity ratio to This will also increase its cost of debt to

With perfect capital markets, what effect will this transaction have on ECOSOL cost of equity and WACC?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock