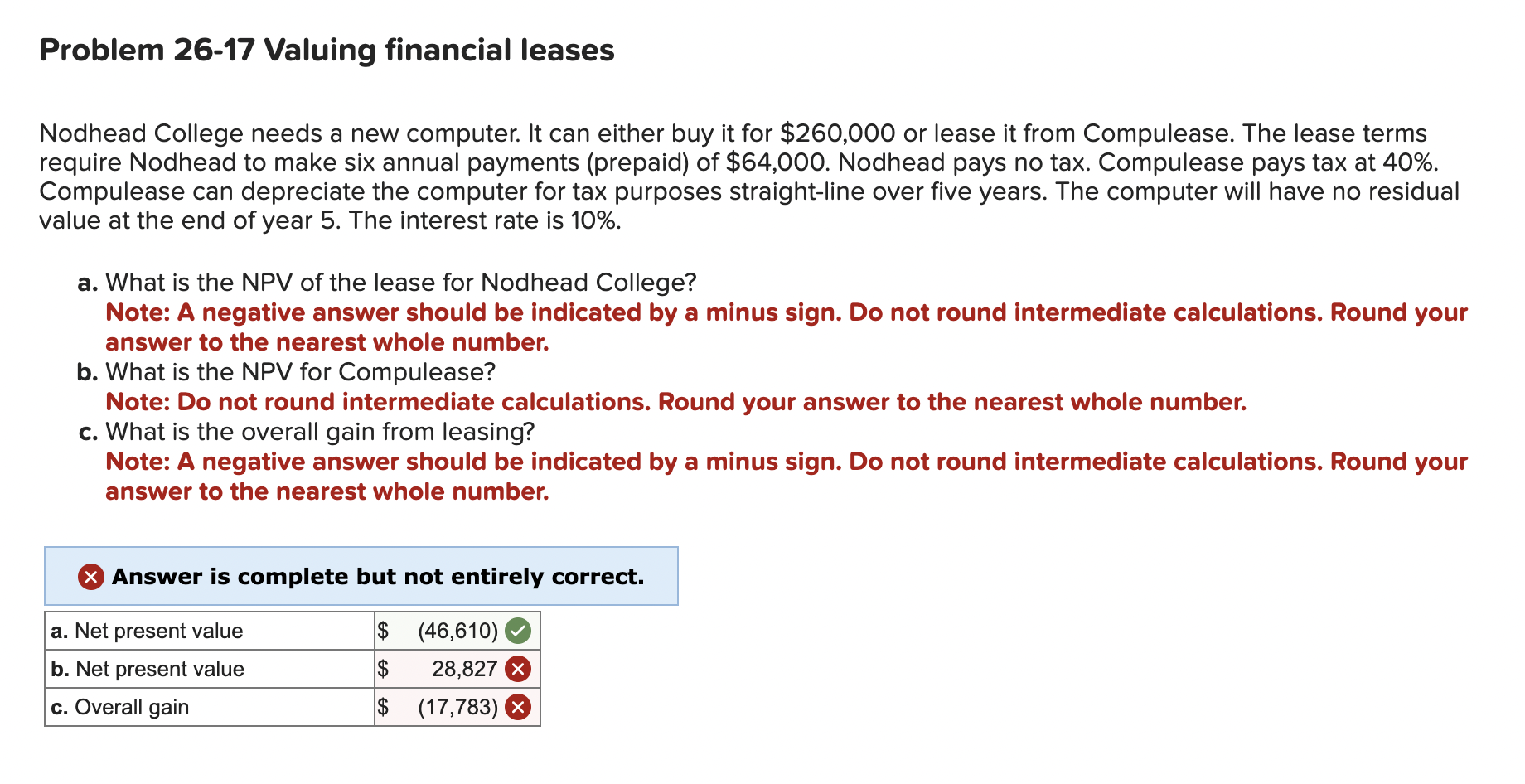

Question: Problem 2 6 - 1 7 Valuing financial leases Nodhead College needs a new computer. It can either buy it for $ 2 6 0

Problem Valuing financial leases

Nodhead College needs a new computer. It can either buy it for $ or lease it from Compulease. The lease terms

require Nodhead to make six annual payments prepaid of $ Nodhead pays no tax. Compulease pays tax at

Compulease can depreciate the computer for tax purposes straightline over five years. The computer will have no residual

value at the end of year The interest rate is

a What is the NPV of the lease for Nodhead College?

Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round your

answer to the nearest whole number.

b What is the NPV for Compulease?

Note: Do not round intermediate calculations. Round your answer to the nearest whole number.

c What is the overall gain from leasing?

Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round your

answer to the nearest whole number.

Answer is complete but not entirely correct.

I need help on B and C

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock