Question: Problem 2 - 6 1 ( LO 2 - 2 , LO 2 - 3 ) ( Algo ) Chaz Corporation has taxable income in

Problem LO LO Algo

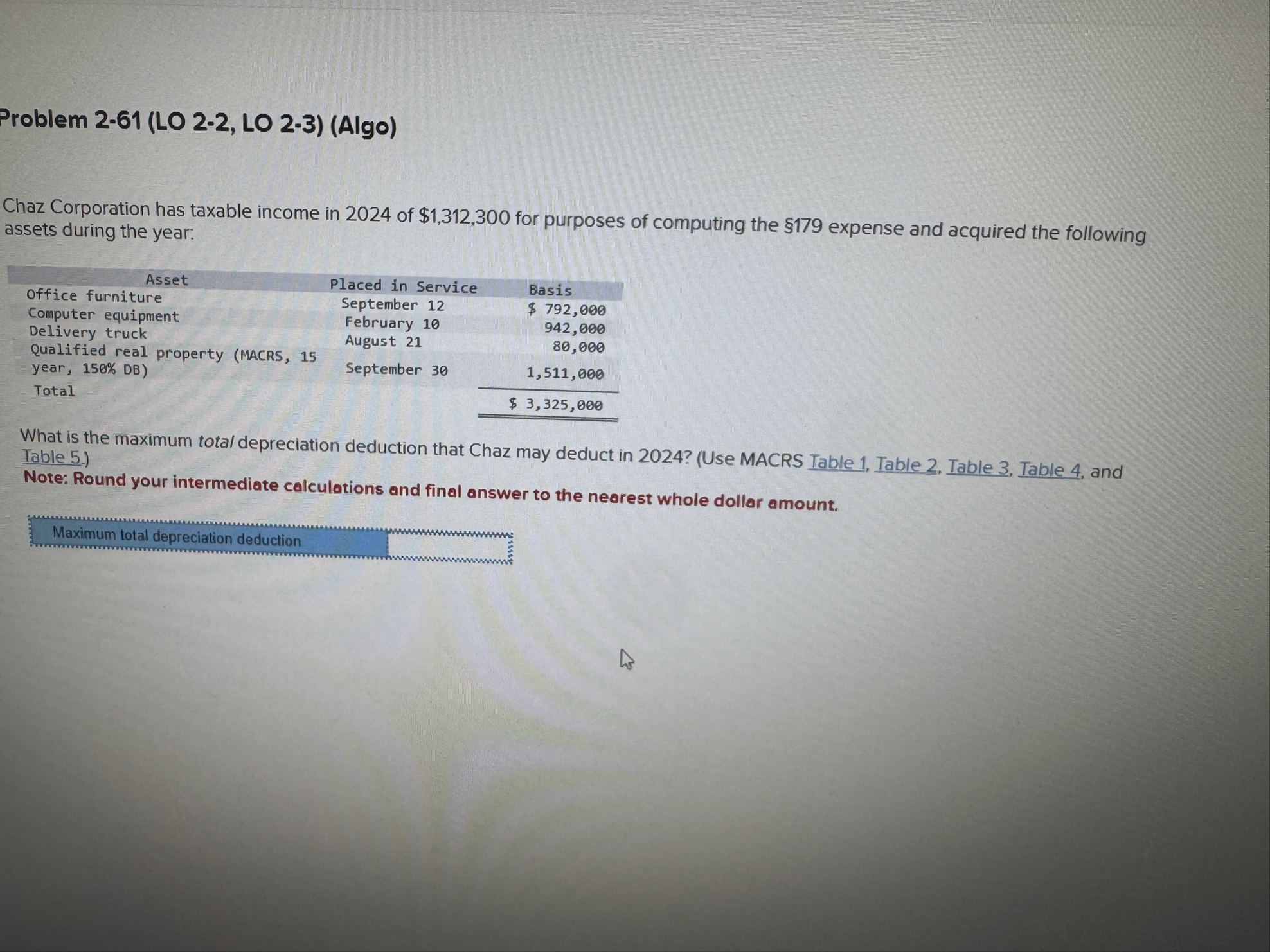

Chaz Corporation has taxable income in of $ for purposes of computing the $ expense and acquired the following assets during the year:

tabletableAssetPlaced in ServiceBasisComputer equipment,February Delivery truck,August Qualified real property MACRSSeptember Total$

What is the maximum total depreciation deduction that Chaz may deduct in Use MACRS Table Table Table Table and Table

Note: Round your intermediate calculations and final answer to the nearest whole dollar amount.

Maximum total depreciation deduction

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock