Question: PROBLEM 2 6 . 8 A Analyzing Competing Capital Investment Proposals LO 2 6 - 1 , LO 2 6 - 2 , LO 2

PROBLEM A Analyzing Competing Capital Investment Proposals LO LO LO LO

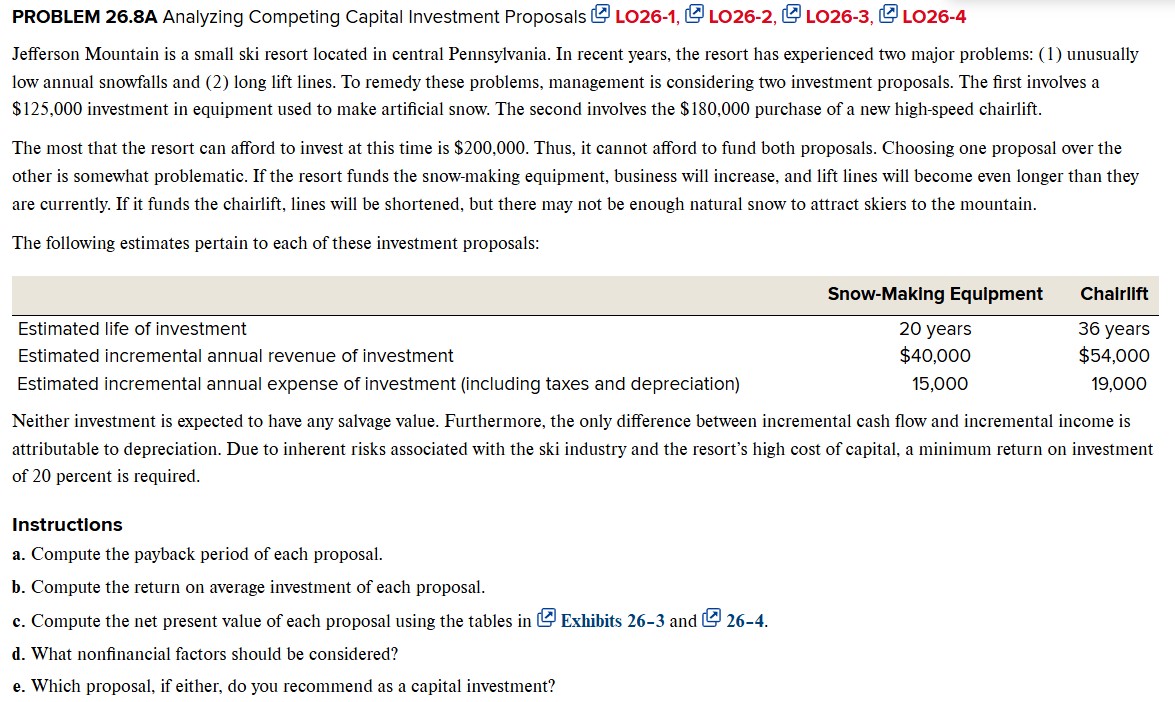

Jefferson Mountain is a small ski resort located in central Pennsylvania. In recent years, the resort has experienced two major problems: unusually low annual snowfalls and long lift lines. To remedy these problems, management is considering two investment proposals. The first involves a $ investment in equipment used to make artificial snow. The second involves the $ purchase of a new highspeed chairlift.

The most that the resort can afford to invest at this time is $ Thus, it cannot afford to fund both proposals. Choosing one proposal over the other is somewhat problematic. If the resort funds the snowmaking equipment, business will increase, and lift lines will become even longer than they are currently. If it funds the chairlift, lines will be shortened, but there may not be enough natural snow to attract skiers to the mountain.

The following estimates pertain to each of these investment proposals:

Table Summary: A table has columns. Column lists account names, while columns and are titled SnowMaking Equipment, and Chairlift and list years and dollar amounts.

SnowMaking Equipment Chairlift

Estimated life of investment years years

Estimated incremental annual revenue of investment $ $

Estimated incremental annual expense of investment including taxes and depreciation

Neither investment is expected to have any salvage value. Furthermore, the only difference between incremental cash flow and incremental income is attributable to depreciation. Due to inherent risks associated with the ski industry and the resorts high cost of capital, a minimum return on investment of percent is required.

Instructions

a Compute the payback period of each proposal.

b Compute the return on average investment of each proposal.

c Compute the net present value of each proposal using the tables in Exhibits and

d What nonfinancial factors should be considered?

e Which proposal, if either, do you recommend as a capital investment?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock