Question: Problem 2 (6 points; 1 points each) Your boss is impressed with your work and asks you to conduct a secondary scenario analysis to complement

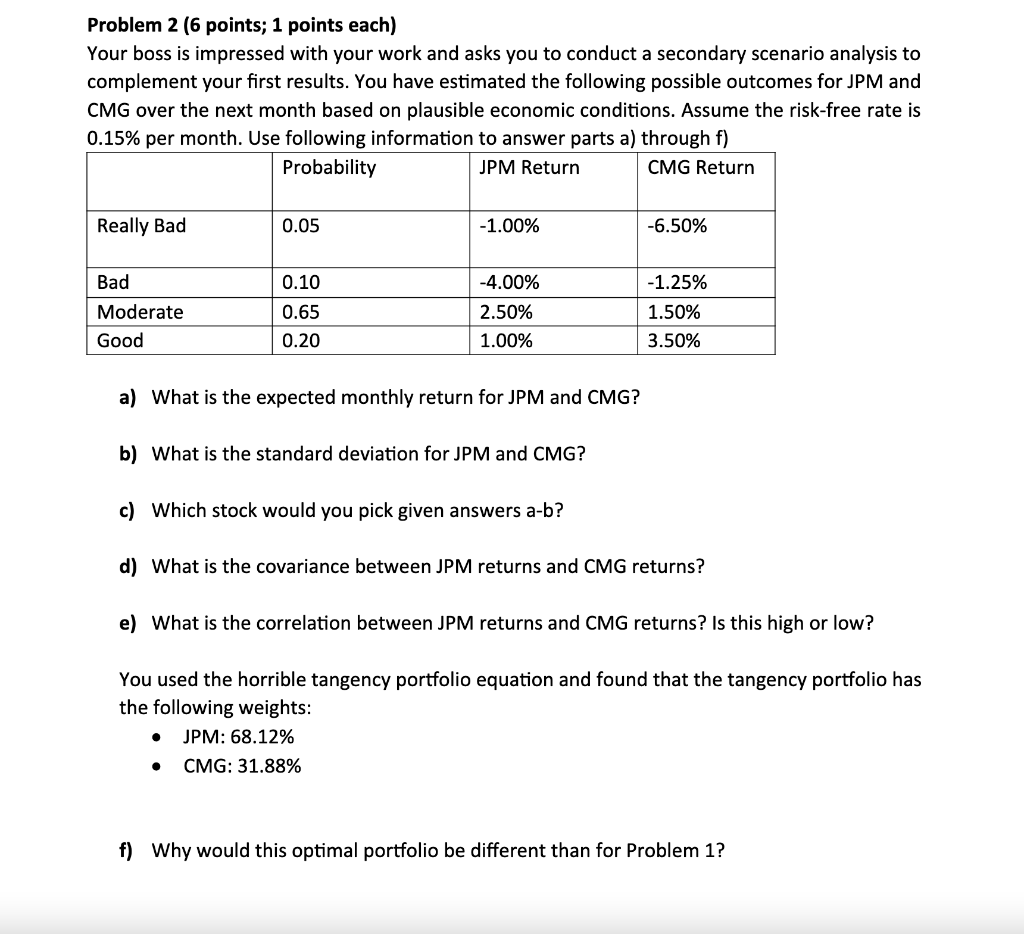

Problem 2 (6 points; 1 points each) Your boss is impressed with your work and asks you to conduct a secondary scenario analysis to complement your first results. You have estimated the following possible outcomes for JPM and CMG over the next month based on plausible economic conditions. Assume the risk-free rate is 0.15% per month. Use following information to answer parts a) through f) Probability JPM Return CMG Return Really Bad 0.05 -1.00% -6.50% Bad 0.10 0.65 Moderate Good -4.00% 2.50% 1.00% -1.25% 1.50% 3.50% 0.20 a) What is the expected monthly return for JPM and CMG? b) What is the standard deviation for JPM and CMG? c) Which stock would you pick given answers a-b? d) What is the covariance between JPM returns and CMG returns? e) What is the correlation between JPM returns and CMG returns? Is this high or low? You used the horrible tangency portfolio equation and found that the tangency portfolio has the following weights: JPM: 68.12% CMG: 31.88% . . f) Why would this optimal portfolio be different than for Problem 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts