Question: Problem 2: (6 points) Answer the below questions: (1) What is the equivalent taxable yield for an investor facing a 40% marginal tax rate, and

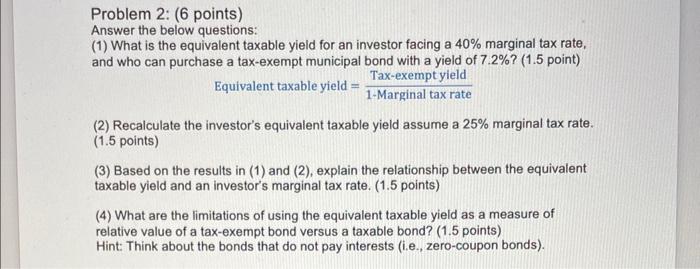

Problem 2: (6 points) Answer the below questions: (1) What is the equivalent taxable yield for an investor facing a 40% marginal tax rate, and who can purchase a tax-exempt municipal bond with a yield of 7.2\%? (1.5 point) Equivalenttaxableyield=1MarginaltaxrateTax-exemptyield (2) Recalculate the investor's equivalent taxable yield assume a 25% marginal tax rate. (1.5 points) (3) Based on the results in (1) and (2), explain the relationship between the equivalent taxable yield and an investor's marginal tax rate. (1.5 points) (4) What are the limitations of using the equivalent taxable yield as a measure of relative value of a tax-exempt bond versus a taxable bond? (1.5 points) Hint: Think about the bonds that do not pay interests (i.e., zero-coupon bonds)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts