Question: Problem 2 (6 points) Michael is an investor based in New York He holds 100 shares of Bescherelle, a French firm that went public in

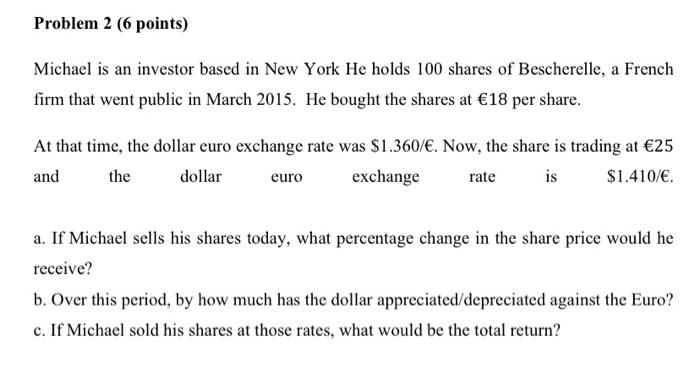

Problem 2 (6 points) Michael is an investor based in New York He holds 100 shares of Bescherelle, a French firm that went public in March 2015. He bought the shares at 18 per share. At that time, the dollar euro exchange rate was $1.360/. Now, the share is trading at 25 and the dollar euro exchange rate is $1.410/. a. If Michael sells his shares today, what percentage change in the share price would he receive? b. Over this period, by how much has the dollar appreciated/depreciated against the Euro? c. If Michael sold his shares at those rates, what would be the total return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts