Question: Problem 2. (60 points) Consider, as we did in class, a representative investor who lives for two peri- ods (t and t+1) and has income

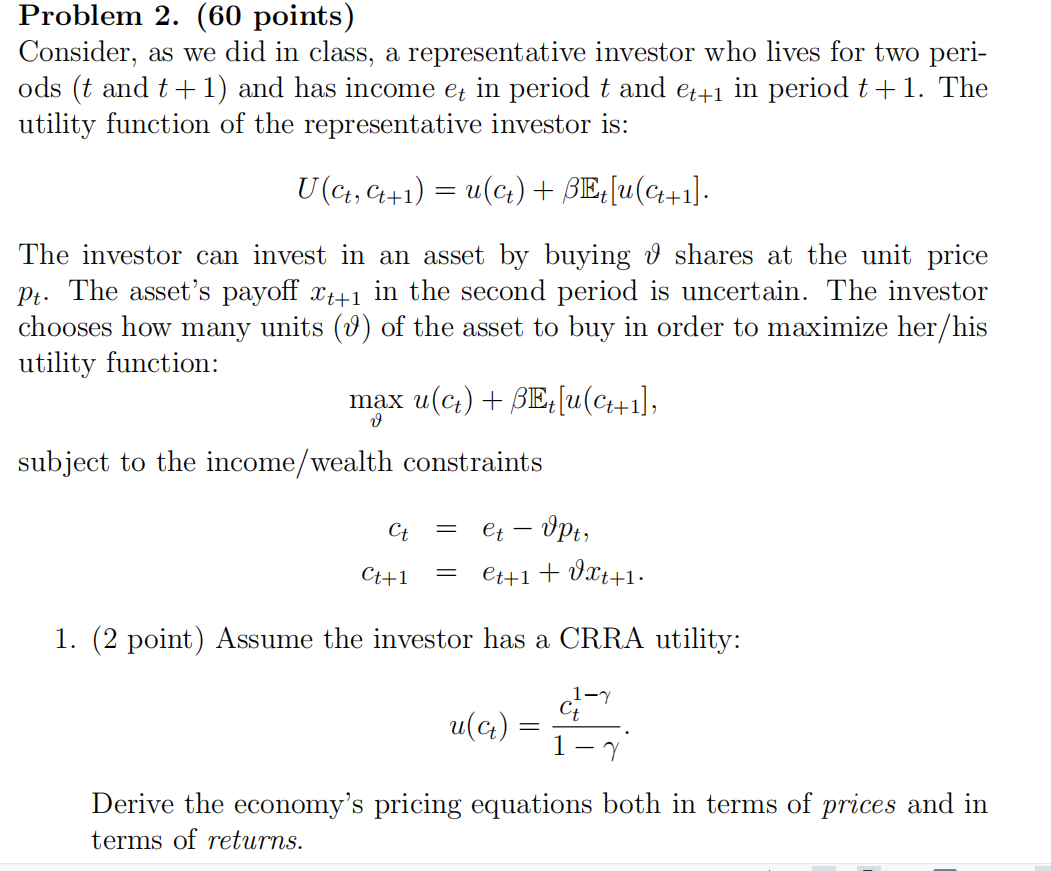

Problem 2. (60 points) Consider, as we did in class, a representative investor who lives for two peri- ods (t and t+1) and has income et in period t and C++1 in period t+1. The utility function of the representative investor is: U(C+, C++1) = u(ct) + BEt[u(C+1). = The investor can invest in an asset by buying 0 shares at the unit price Pt. The asset's payoff Xt+1 in the second period is uncertain. The investor chooses how many units (1) of the asset to buy in order to maximize her/his utility function: max u(c) + BEt [u(C++1], subject to the income/wealth constraints Ct = et - Opt, et+1 + 0xt+1. Ct+1 = 1. (2 point) Assume the investor has a CRRA utility: u(c) 1-7 ct 1 7 Derive the economy's pricing equations both in terms of prices and in terms of returns. Problem 2. (60 points) Consider, as we did in class, a representative investor who lives for two peri- ods (t and t+1) and has income et in period t and C++1 in period t+1. The utility function of the representative investor is: U(C+, C++1) = u(ct) + BEt[u(C+1). = The investor can invest in an asset by buying 0 shares at the unit price Pt. The asset's payoff Xt+1 in the second period is uncertain. The investor chooses how many units (1) of the asset to buy in order to maximize her/his utility function: max u(c) + BEt [u(C++1], subject to the income/wealth constraints Ct = et - Opt, et+1 + 0xt+1. Ct+1 = 1. (2 point) Assume the investor has a CRRA utility: u(c) 1-7 ct 1 7 Derive the economy's pricing equations both in terms of prices and in terms of returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts