Question: Problem 2 - ( 7 marks total ) Explicitly using course concepts that comprise decision usefulness, explain why RRA for oil and gas could be

Problem marks total

Explicitly using course concepts that comprise decision usefulness, explain why RRA for oil and

gas could be useful for potential investors. List at least two things that, if you were consulting the

SEC on future policy issues, that you might change and explain why. This should be a short one

paragraph answer, but do name at least two course concepts we have discussed that underlie

decision usefulness and two things that you would potentially change about RRA. marks

Problem marks total

Assume an investor has prior subjective probabilities of a firm's future economic performance

being High as and for the same firm has prior subjective probabilities of future

performance being low as The investor is risk adverse, with utility equal to the square

root of the payoff. marks

Assume the following information system is provided

Also assume an investor's net payoff is $ if future performance is high, and $ if

future performance is low. Show the investor's expected utility given this new information if bad

news is observed. Show all calculations, including writing out Bayes' formula in symbol form

appropriate for this problem. Round numbers to two decimal places. marks

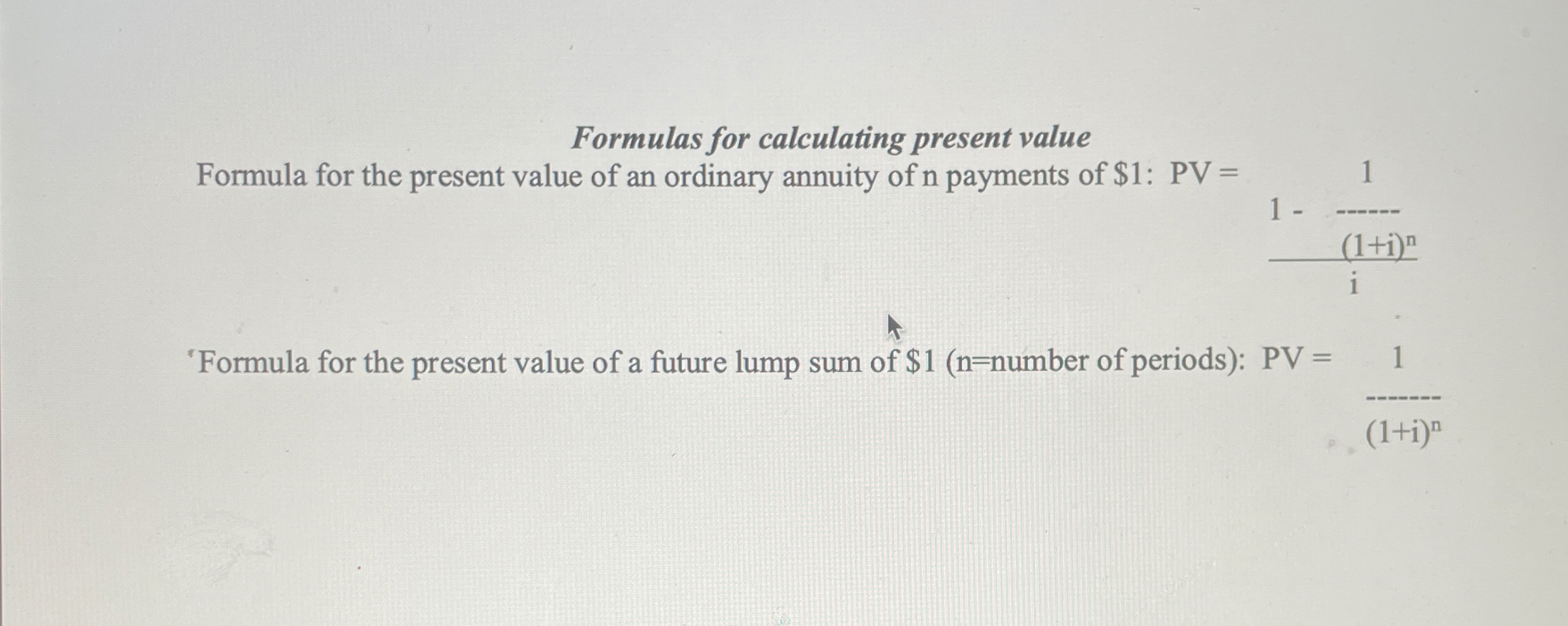

Formulas for calculating present value

Formula for the present value of an ordinary annuity of n payments of $:

Formula for the present value of a future lump sum of $ number of periods:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock