Question: Problem 2 (7 marks) You have just completed an analysis of the capital budgeting investments for next year. The company's projects have an average required

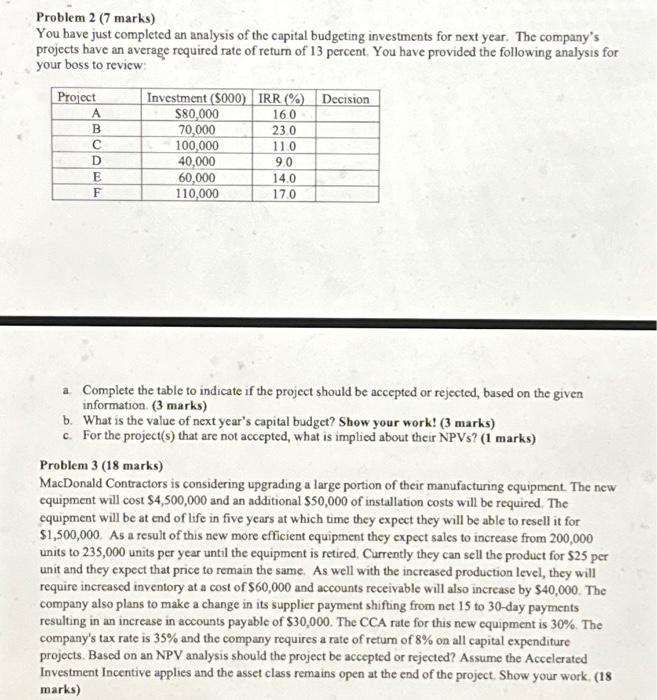

Problem 2 (7 marks) You have just completed an analysis of the capital budgeting investments for next year. The company's projects have an average required rate of return of 13 percent. You have provided the following analysis for your boss to review: a. Complete the table to indicate if the project should be accepted or rejected, based on the given information. (3 marks) b. What is the value of next year's capital budget? Show your work! ( 3 marks) c. For the project(s) that are not accepted, what is implied about their NPVs? (1 marks) Problem 3 (18 marks) MacDonald Contractors is considering upgrading a large portion of their manufacturing equipment. The new equipment will cost $4,500,000 and an additional $50,000 of installation costs will be required. The equipment will be at end of life in five years at which time they expect they will be able to resell it for $1,500,000, As a result of this new more efficient equipment they expect sales to increase from 200,000 units to 235,000 units per year until the equipment is retired. Currently they can sell the product for $25 per unit and they expect that price to remain the same. As well with the increased production level, they will require increased inventory at a cost of $60,000 and accounts receivable will also increase by $40,000. The company also plans to make a change in its supplier payment shifting from net 15 to 30 -day payments resulting in an increase in accounts payable of $30,000. The CCA rate for this new equipment is 30%. The company's tax rate is 35% and the company requires a rate of return of 8% on all capital expenditure projects. Based on an NPV analysis should the project be accepted or rejected? Assume the Accelerated Investment Incentive applies and the asset class remains open at the end of the project. Show your work, (18 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts