Question: Problem 2 (7 marks) You have just completed and analysis of the capital budgeting investments for next year. The company's project have an average required

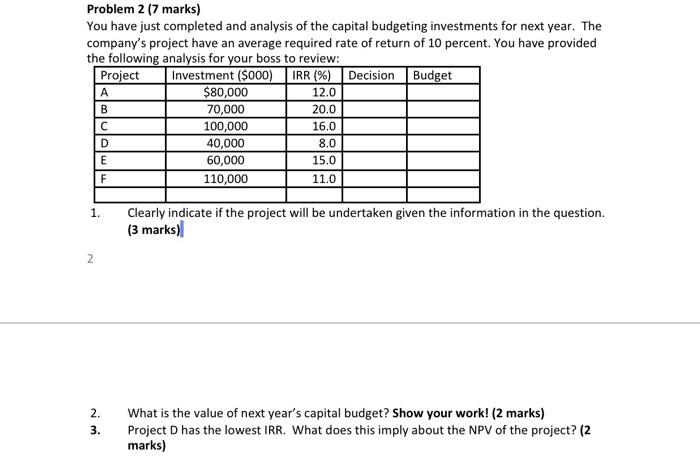

Problem 2 (7 marks) You have just completed and analysis of the capital budgeting investments for next year. The company's project have an average required rate of return of 10 percent. You have provided the following analysis for your boss to review: Project Investment ($000) IRR (%) Decision Budget A $80,000 12.0 70,000 20.0 100,000 16.0 D 40,000 8.0 E 60,000 15.0 F 110,000 11.0 B 1. Clearly indicate if the project will be undertaken given the information in the question. (3 marks) 2 2. 3. What is the value of next year's capital budget? Show your work! (2 marks) Project D has the lowest IRR. What does this imply about the NPV of the project? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts