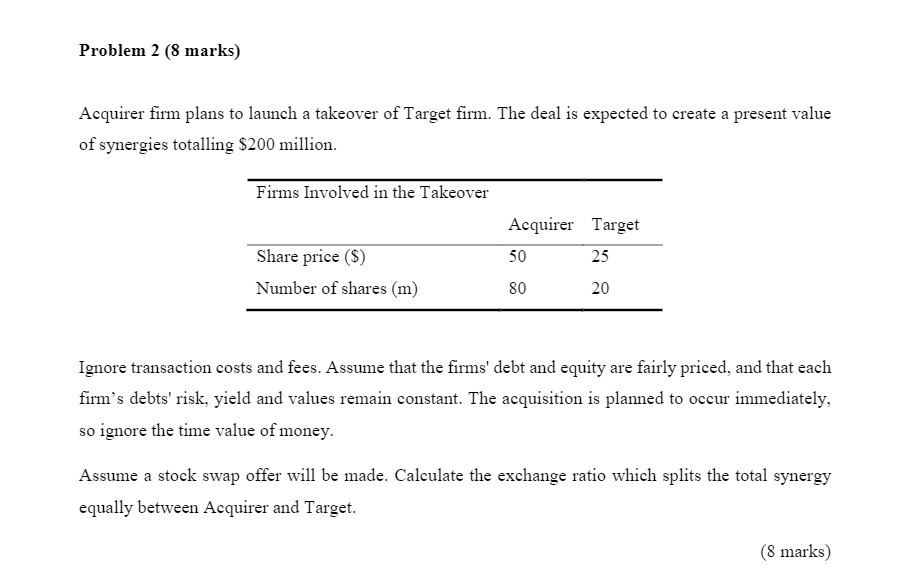

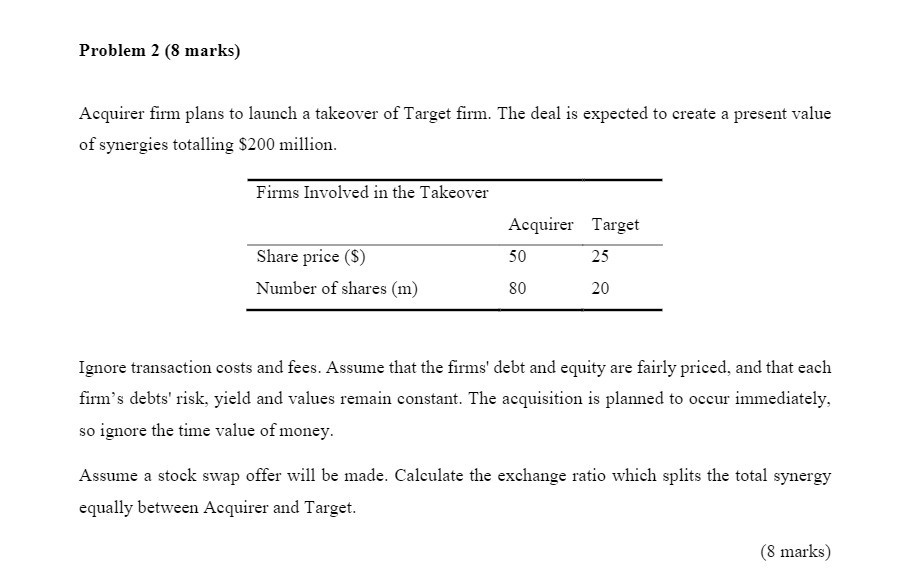

Question: Problem 2 (8 marks) Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies

Problem 2 (8 marks) Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies totalling $200 million. Firms Involved in the Takeover Acquirer Target Share price ($) 50 25 Number of shares (m) 80 20 Ignore transaction costs and fees. Assume that the firms' debt and equity are fairly priced, and that each firm's debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money. Assume a stock swap offer will be made. Calculate the exchange ratio which splits the total synergy equally between Acquirer and Target. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts