Question: Problem 2 [8 points) You have a project with CFs as presented below. What is NPV, IRR, SPB, DPB in case if discount rate is

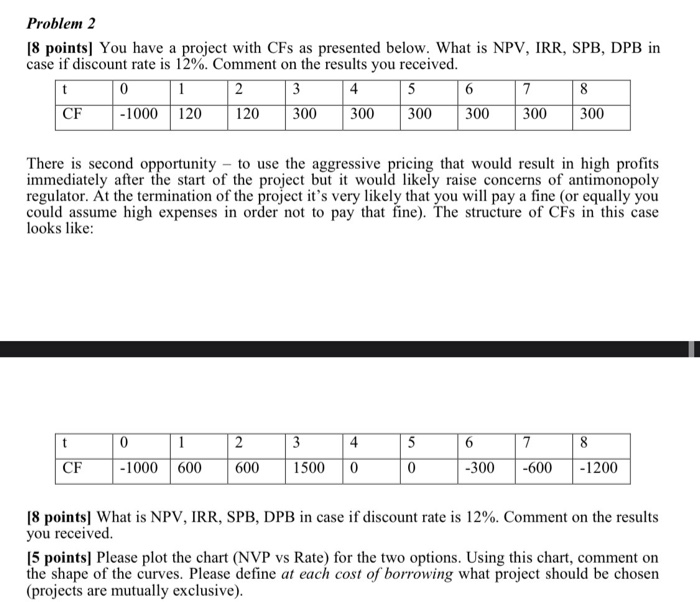

Problem 2 [8 points) You have a project with CFs as presented below. What is NPV, IRR, SPB, DPB in case if discount rate is 12%. Comment on the results you received. 1 2 3 4 5 6 7 8 -1000 120 120 300 300 300 300 300 300 There is second opportunity - to use the aggressive pricing that would result in high profits immediately after the start of the project but it would likely raise concerns of antimonopoly regulator. At the termination of the project it's very likely that you will pay a fine (or equally you could assume high expenses in order not to pay that fine). The structure of CFs in this case looks like: t 0 -1000 1 600 2 600 3 4 15000 5 0 6 -300 7 -600 8 -1200 18 points What is NPV, IRR, SPB, DPB in case if discount rate is 12%. Comment on the results you received. 15 points Please plot the chart (NVP vs Rate) for the two options. Using this chart, comment on the shape of the curves. Please define at each cost of borrowing what project should be chosen (projects are mutually exclusive)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts