Question: problem 2 9 : The estimated deficiency can be determined by: a . Deducting the total free assets to the total unsecured liabilities without priority

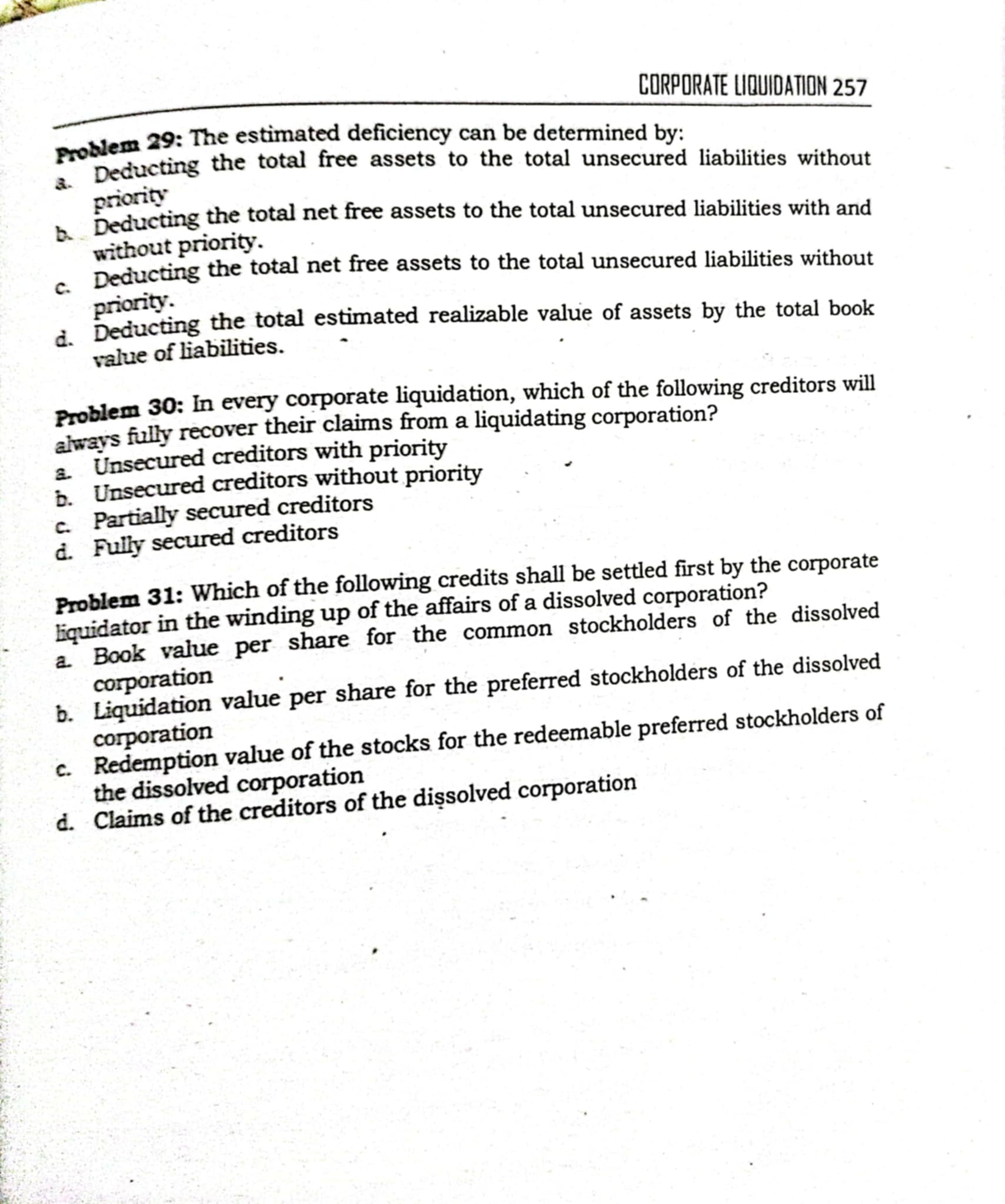

problem : The estimated deficiency can be determined by:

a Deducting the total free assets to the total unsecured liabilities without priority

b Deducting the total net free assets to the total unsecured liabilities with and without priority.

c Deducting the total net free assets to the total unsecured liabilities without priority.

d Deducting the total estimated realizable value of assets by the total book value of liabilities.

Problem : In every corporate liquidation, which of the following creditors will always fully recover their claims from a liquidating corporation?

a Unsecured creditors with priority

b Unsecured creditors without priority

c Partially secured creditors

d Fully secured creditors

Problem : Which of the following credits shall be settled first by the corporate Equidator in the winding up of the affairs of a dissolved corporation?

a Book value per share for the common stockholders of the dissolved corporation

b Liquidation value per share for the preferred stockholders of the dissolved corporation

c Redemption value of the stocks for the redeemable preferred stockholders of the dissolved corporation

d Claims of the creditors of the dissolved corporation

a Free Assets

b Current Assets

c Assets pledged to partially secured creditors

d Assets pledged to fully secured creditors

Problem : These are liabilities secured by assets with estimated realizable values that is equal or greater than the amount of liabilities:

a Partially secured liabilities

c Fully Secured liabilities

b Unsecured with priority liabilities

d Unsecured without priority liability

Problem : Total estimated realizable value of assets less total unsecured liabilities with priorities and the estimated realizable value of assets pledged to fully and partially secured liabilities is equal to:

a Net Free assets

b Free Assets

c Estimated Deficiency

d Unsecured liability without priority

Problem : Liabilities in statement of affairs are classified as follows:

a Fully secured, partially secured and unsecured liability with priority liabilities

b Partially secured, unsecured with and without priority liabilities

c Fully secured, partially secured, unsecured with and without priority liabilities

d Secured and unsecured liabilities

Problem : It is the initial report prepared by the trustee in liquidating a corporation:

a Balance sheet

b Statement of affairs

c Statement of estate equity

Problem : It is a report preptatement liquidation process:

a Statement of cash receipts and disbursements

b Statement of estate deficit

c Statement of baffairs

d Statement of realization and liquidation

Problem : Which of the following statement is incorrect regarding the assets to be realized in the statement of realization and liquidation?

a It is presented in the credit side

c It is measured at book value

b It is the total noncash assets

d None of the choices

Problem : If the total debits is greater than the total credits in the statement of realization, it means:

a There is net gain

b There is net loss

c There is estimated net gain

d There is estimated net loss

in a statement of affairs, assets pledged for partially secured

tose ananst partalily secured liabilities

in plujed nith free assets

pregisted

prove: In accounting for corporate liquidation, which of the following sastrents is incorrect?

Fuir secured creditors no longer share in the remaining free assets after pasment of unsecured liabilities without priority.

Assets used as security for partially secured liabilities are offset to their seured debts and can no donger be used to pay unsecured liabilities.

c Unsecuredicent can always be fully recovered by the employees and taxes cue to govemmente liquidation. corporate bquid ton.

d The unsecured portion of the liabilities to partially secured creditors are added to unsecured credits without priority in the computation of recovery percentage of the unsecured creditors without priority.

problem : The free assets of the entity under corporate liquidation will be distributed to:

a Unsecured creditors with and without priority

b Partially secured creditors, Unsecured creditors with and without priority

c Unsecured creditors with and without priority and shareholders

d Fully secured, partially secured, unsecured creditors and shareholders

Problem : In the statement of affairs, the entity shall report the assets at:

a Book value

c Historical cost

b Fair value

d Net realizable value

Problem : The estimated gain or losses upon liquidation in the statement of aftairs is equal to:

a Book value of assets less book value of liabilities

b Estimated realizable value of assets less book value of liabilities

c Book value of assets less estimated realizable value of assets

d Estimated realizable value of assets less the amount assigned to secured creditors

Problem : The statement of affairs shows a dividend of The dividend means that:

a Secured creditors will receive an amount in excess of t

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock