Question: PROBLEM 2 A and B, calendar year individuals, are equal partners in a real estate partnership. In the current year, the partnership had gross

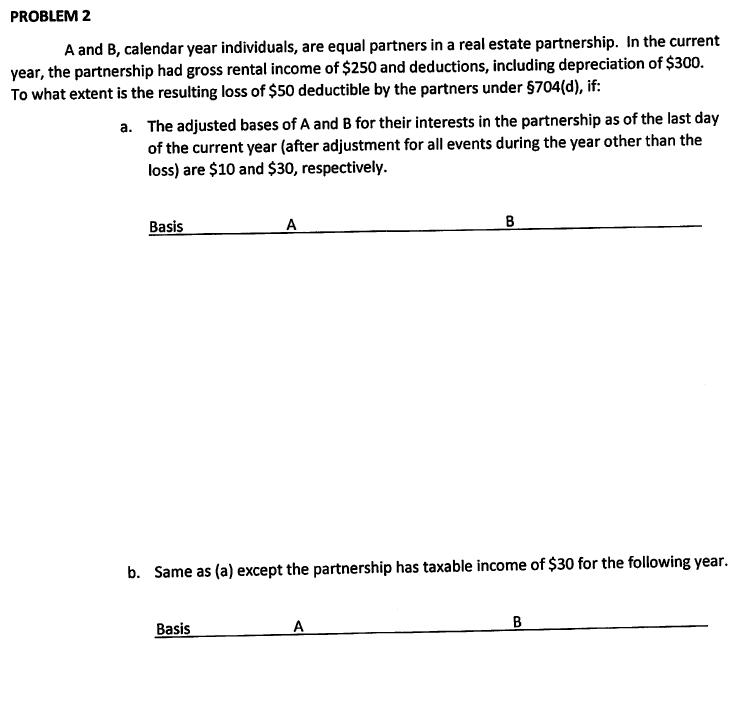

PROBLEM 2 A and B, calendar year individuals, are equal partners in a real estate partnership. In the current year, the partnership had gross rental income of $250 and deductions, including depreciation of $300. To what extent is the resulting loss of $50 deductible by the partners under $704(d), if: a. The adjusted bases of A and B for their interests in the partnership as of the last day of the current year (after adjustment for all events during the year other than the loss) are $10 and $30, respectively. Basis A Basis b. Same as (a) except the partnership has taxable income of $30 for the following year. B A B

Step by Step Solution

There are 3 Steps involved in it

Partnership Loss Deduction under 704d This scenario involves a partnership loss 250 gross income 300 deductions 50 net loss and the limitations on partner deductibility according to Internal Revenue C... View full answer

Get step-by-step solutions from verified subject matter experts