Question: PROBLEM 2: A candy company needs to buy a large quantity of cocoa to make chocolate Easter bunnies, which it will make and ship to

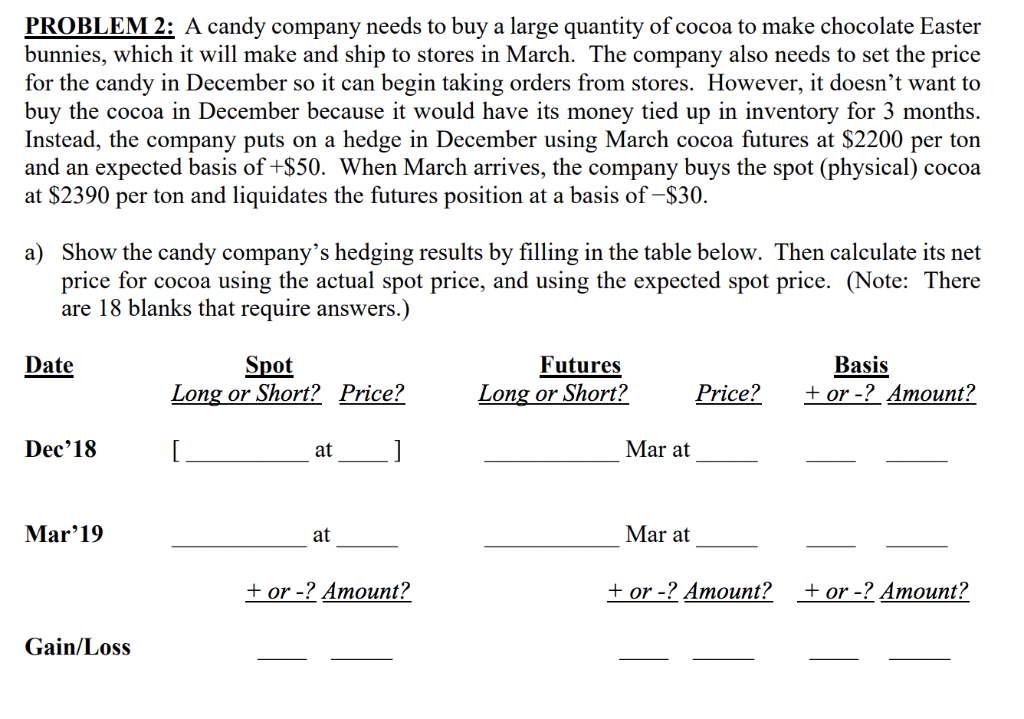

PROBLEM 2: A candy company needs to buy a large quantity of cocoa to make chocolate Easter bunnies, which it will make and ship to stores in March. The company also needs to set the price for the candy in December so it can begin taking orders from stores. However, it doesn't want to buy the cocoa in December because it would have its money tied up in inventory for 3 months. Instead, the company puts on a hedge in December using March cocoa futures at $2200 per ton and an expected basis of +$50. When March arrives, the company buys the spot (physical) cocoa at $2390 per ton and liquidates the futures position at a basis of -$30. a) Show the candy company's hedging results by filling in the table below. Then calculate its net price for cocoa using the actual spot price, and using the expected spot price. (Note: There are 18 blanks that require answers.) Date Spot Futures Long or Short? Basis Long or Short?Price Price? tor-2Amount? Dec'18 at Mar at Mar'19 at Mar at + or -? Amount? + or-? Amount? or -? Amount? Gain/Loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts