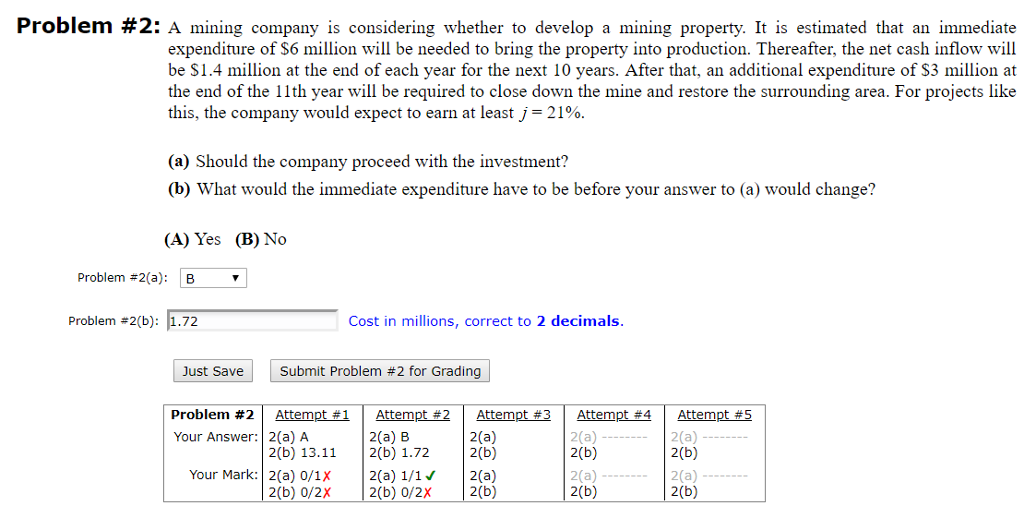

Question: Problem #2: A mining company is considering whether to develop a mining property. It is estimated that an immediate expenditure of S6 million will be

Problem #2: A mining company is considering whether to develop a mining property. It is estimated that an immediate expenditure of S6 million will be needed to bring the property into production. Thereafter, the net cash inflow will be S1.4 million at the end of each year for the next 10 years. After that, an additional expenditure of S3 million at the end of the 11th year will be required to close down the mine and restore the surrounding area. For projects like this, the company would expect to earn at least 1-21% (a) Should the company proceed with the investment? (b) What would the immediate expenditure have to be before your answer to (a) would change? (A) Yes (B) No Problem #2(a): B Problem #2(b): 1.72 Cost in millions, correct to 2 decimals Save | | Submit Problem #2 for Grading Attempt #2 | Attempt #3 | Attempt #4 2(a) B Attempt #5 2 (a) 2(b) 2(a) 2(b) Problem #2 Attempt #1 2(a) 2(b) 13.11 2(b) 1.722(b) Your Mark: 2(a) 0/1X 2(a) 1/12(a) 2(b) 0/2X 2(b) 0/2X2(b) 2(a) 2(b) 2(a) 2(b) Your Answer: 2(a) A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts