Question: Problem 2. A stock sells for $50 today. The riskless rate over the period is 10%. Assume that next period (one year) the stock will

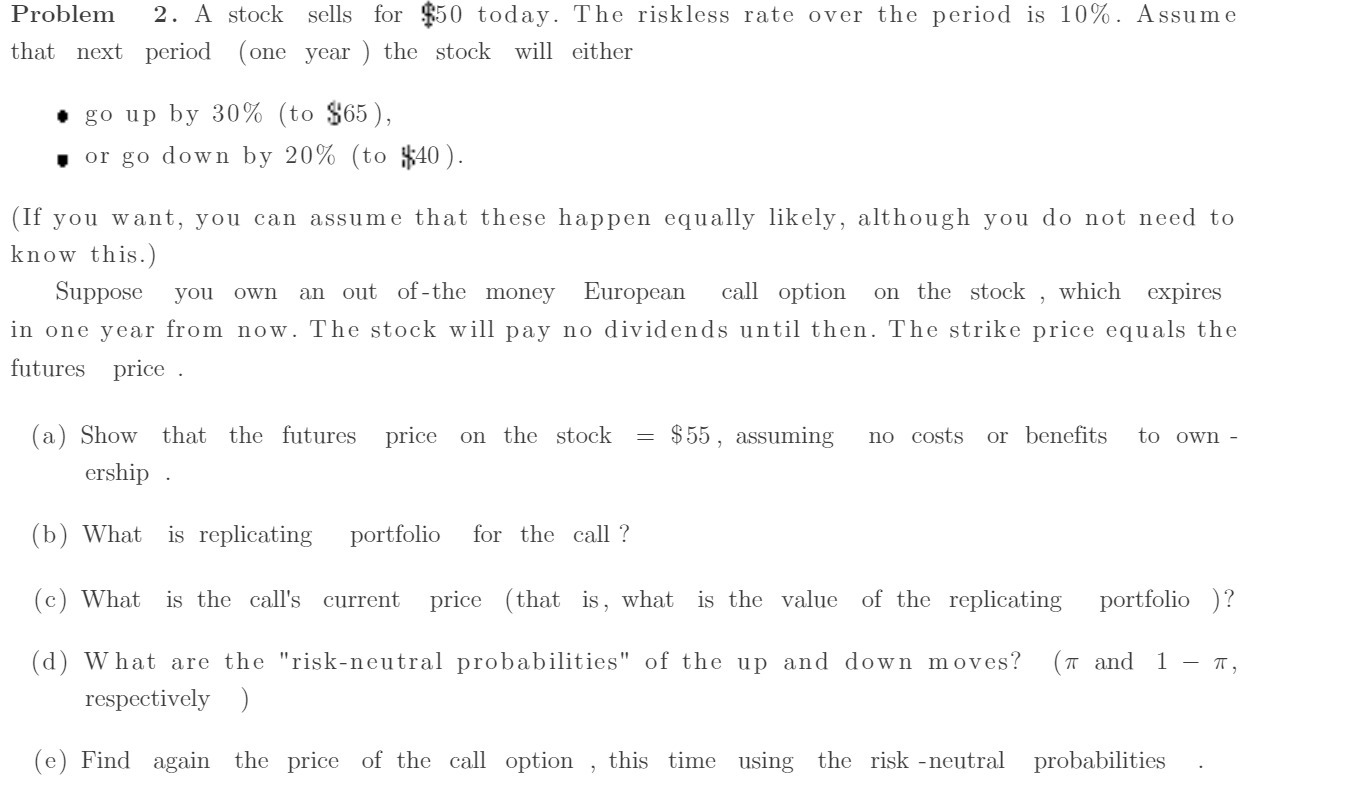

Problem 2. A stock sells for $50 today. The riskless rate over the period is 10%. Assume that next period (one year) the stock will either 0 go up by 30% (to $65), ' or go down by 20% (to $40). (If you want, you can assume that these happen equally likely, although you do not need to know this.) Suppose yell own an out of~the money European call option on the stock , which expires in one year from now. The stock will pay no dividends until then. The strike price equals the futures price . (a) Show that the futures price on the stock 2 $55, assuming no costs or benets to own - ership . (b) What is replicating portfolio for the call ? (e) What is the call's current price (that is, what is the value of the replicating portfolio )? (d) What are the \"riskneutral probabilities\" of the 11p and down moves? (7r and 1 i 71', respectively ) ( e) Find again the price of the call option ,this time using the risk neutral probabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts