Question: Problem 2 A trader buys one 1-year ATM call and sells one 1-year ATM put on a non-dividend-paying stock. All options are European, So =

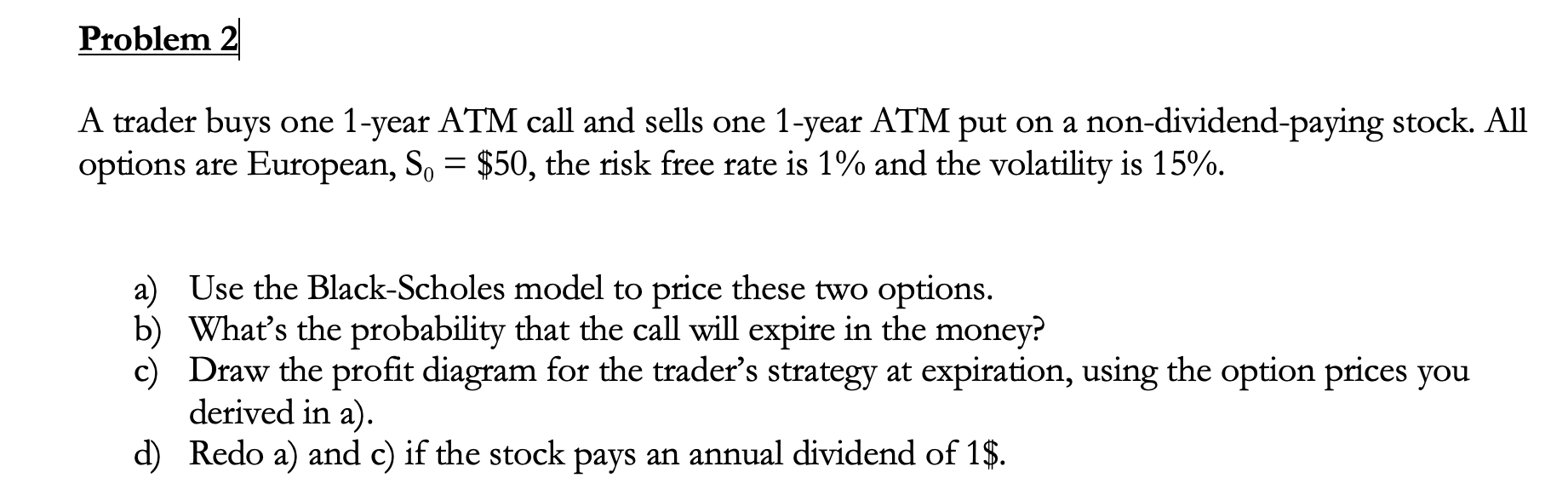

Problem 2 A trader buys one 1-year ATM call and sells one 1-year ATM put on a non-dividend-paying stock. All options are European, So = $50, the risk free rate is 1% and the volatility is 15%. a) Use the Black-Scholes model to price these two options. b) What's the probability that the call will expire in the money? c) Draw the profit diagram for the trader's strategy at expiration, using the option prices you derived in a). d) Redo a) and c) if the stock pays an annual dividend of 1$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts