Question: Problem 2: A trader takes a long position and a hedge fund takes a short position on ten 1- month S&P 500 futures contracts at

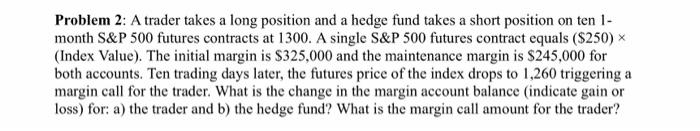

Problem 2: A trader takes a long position and a hedge fund takes a short position on ten 1- month S&P 500 futures contracts at 1300. A single S&P 500 futures contract equals ($250) (Index Value). The initial margin is $325,000 and the maintenance margin is $245,000 for both accounts. Ten trading days later, the futures price of the index drops to 1,260 triggering a margin call for the trader. What is the change in the margin account balance indicate gain or loss) for: a) the trader and b) the hedge fund? What is the margin call amount for the trader

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts