Question: problem #2 a. What is the depreciation during the second year? c. What is the BV of the asset after 10 years? d. Solve a,

problem #2

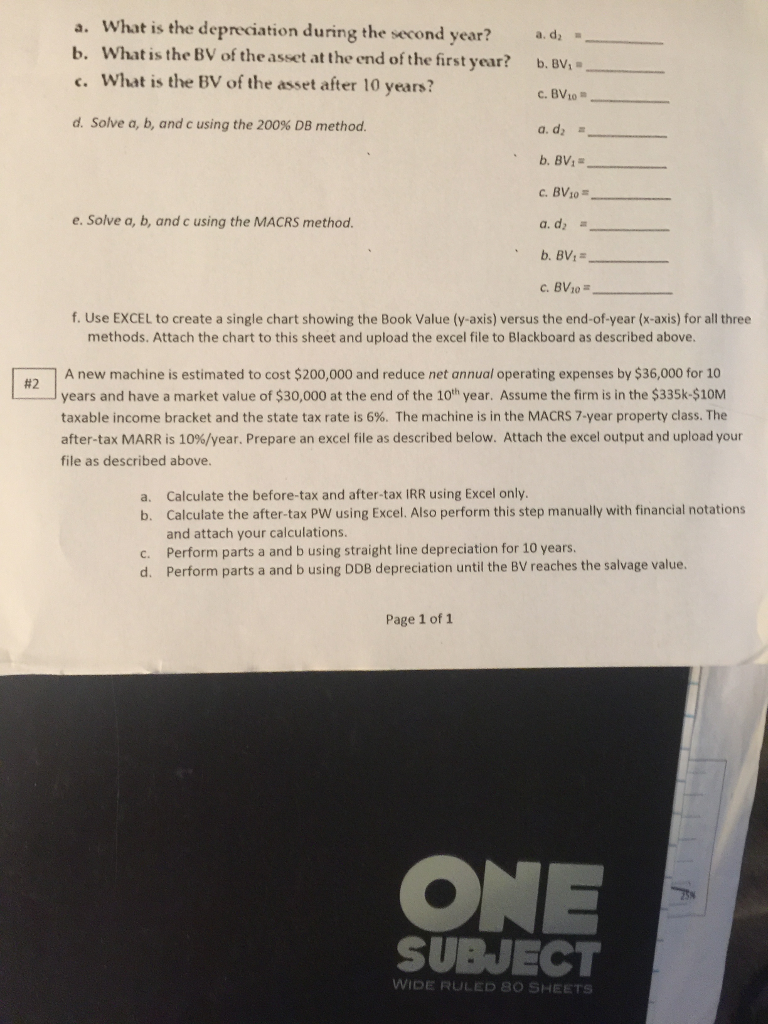

a. What is the depreciation during the second year? c. What is the BV of the asset after 10 years? d. Solve a, b, and c using the 200% DB method. a. d2 he end of the first year? b. BVi e. Solve a, b, and c using the MACRS method. a. d a c. BV10= f. Use EXCEL to create a single chart showing the Book Value (y-axis) versus the end-of-year (x-axis) for all three methods. Attach the chart to this sheet and upload the excel file to Blackboard as described above A new machine is estimated to cost $200,000 and reduce net annual operating expenses by $36,000 for 10 years and have a market value of $30,000 at the end of the 10th year. Assume the firm is in the $335k-$10M taxable income bracket and the state tax rate is 6%. The machine is in the MACRS 7-year property class. The after-tax MARR is 10%/year. Prepare an excel file as described below. Attach the excel output and upload your file as described above #2 Calculate the before-tax and after-tax IRR using Excel only Calculate the after-tax PW using Excel. Also perform this step manually with financial notations and attach your calculations. a. b. c. Perform parts a and b using straight line depreciation for 10 years d. Perform parts a and b using DDB depreciation until the BV reaches the salvage value. Page 1 of 1 ONE SUBJECT WIDE RULED 80 SHEETS a. What is the depreciation during the second year? c. What is the BV of the asset after 10 years? d. Solve a, b, and c using the 200% DB method. a. d2 he end of the first year? b. BVi e. Solve a, b, and c using the MACRS method. a. d a c. BV10= f. Use EXCEL to create a single chart showing the Book Value (y-axis) versus the end-of-year (x-axis) for all three methods. Attach the chart to this sheet and upload the excel file to Blackboard as described above A new machine is estimated to cost $200,000 and reduce net annual operating expenses by $36,000 for 10 years and have a market value of $30,000 at the end of the 10th year. Assume the firm is in the $335k-$10M taxable income bracket and the state tax rate is 6%. The machine is in the MACRS 7-year property class. The after-tax MARR is 10%/year. Prepare an excel file as described below. Attach the excel output and upload your file as described above #2 Calculate the before-tax and after-tax IRR using Excel only Calculate the after-tax PW using Excel. Also perform this step manually with financial notations and attach your calculations. a. b. c. Perform parts a and b using straight line depreciation for 10 years d. Perform parts a and b using DDB depreciation until the BV reaches the salvage value. Page 1 of 1 ONE SUBJECT WIDE RULED 80 SHEETS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts