Question: Problem 2. An Investment problem analysis - This problem requires understanding Goal Programming Models and Applications You are working for an investment firm which manages

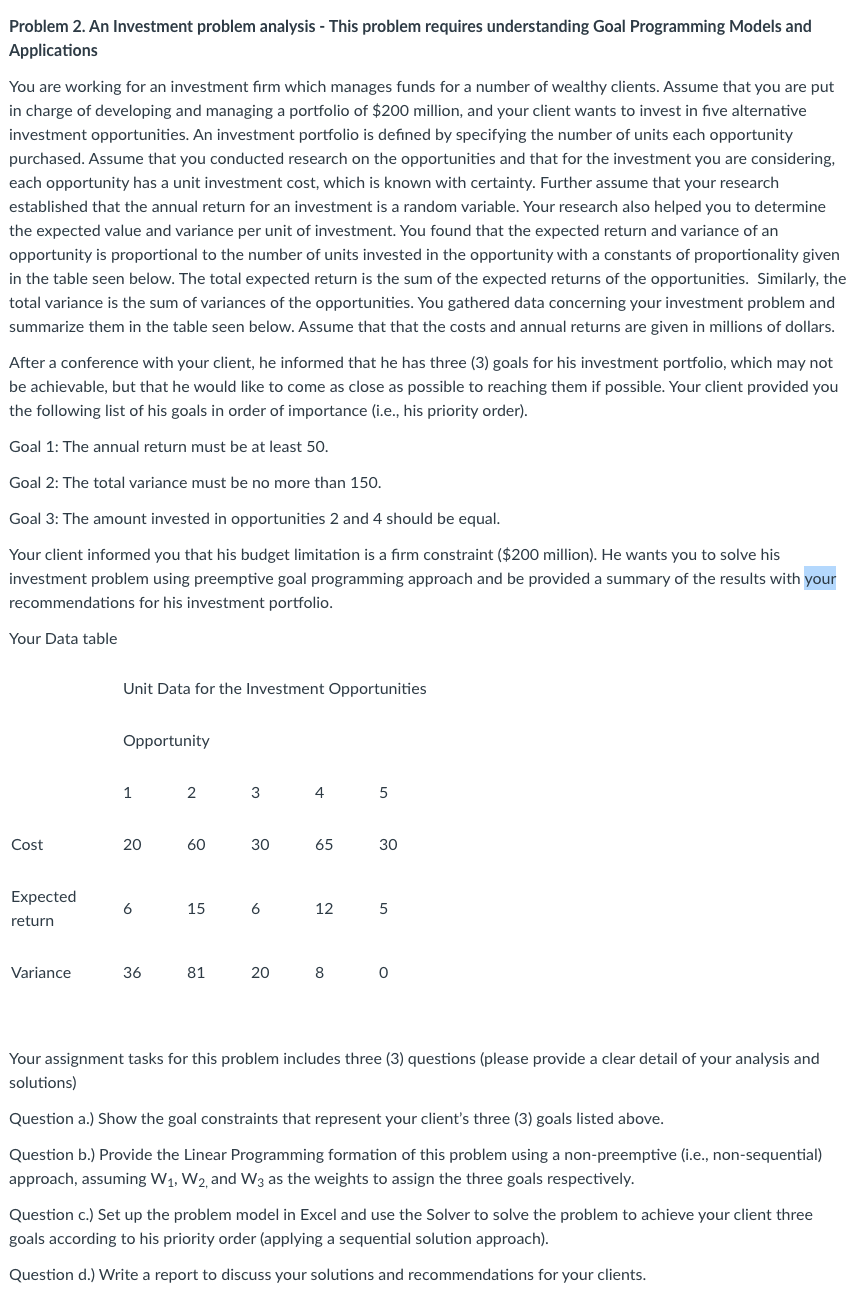

Problem 2. An Investment problem analysis - This problem requires understanding Goal Programming Models and Applications You are working for an investment firm which manages funds for a number of wealthy clients. Assume that you are put in charge of developing and managing a portfolio of $200 million, and your client wants to invest in five alternative investment opportunities. An investment portfolio is defined by specifying the number of units each opportunity purchased. Assume that you conducted research on the opportunities and that for the investment you are considering, each opportunity has a unit investment cost, which is known with certainty. Further assume that your research established that the annual return for an investment is a random variable. Your research also helped you to determine the expected value and variance per unit of investment. You found that the expected return and variance of an opportunity is proportional to the number of units invested in the opportunity with a constants of proportionality given in the table seen below. The total expected return is the sum of the expected returns of the opportunities. Similarly, the total variance is the sum of variances of the opportunities. You gathered data concerning your investment problem and summarize them in the table seen below. Assume that that the costs and annual returns are given in millions of dollars. After a conference with your client, he informed that he has three (3) goals for his investment portfolio, which may not be achievable, but that he would like to come as close as possible to reaching them if possible. Your client provided you the following list of his goals in order of importance (i.e., his priority order). Goal 1: The annual return must be at least 50. Goal 2: The total variance must be no more than 150. Goal 3: The amount invested in opportunities 2 and 4 should be equal. Your client informed you that his budget limitation is a firm constraint (\$200 million). He wants you to solve his investment problem using preemptive goal programming approach and be provided a summary of the results with your recommendations for his investment portfolio. Your Data table Unit Data for the Investment Opportunities Your assignment tasks for this problem includes three (3) questions (please provide a clear detail of your analysis and solutions) Question a.) Show the goal constraints that represent your client's three (3) goals listed above. Question b.) Provide the Linear Programming formation of this problem using a non-preemptive (i.e., non-sequential) approach, assuming W1,W2, and W3 as the weights to assign the three goals respectively. Question c.) Set up the problem model in Excel and use the Solver to solve the problem to achieve your client three goals according to his priority order (applying a sequential solution approach). Question d.) Write a report to discuss your solutions and recommendations for your clients

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts