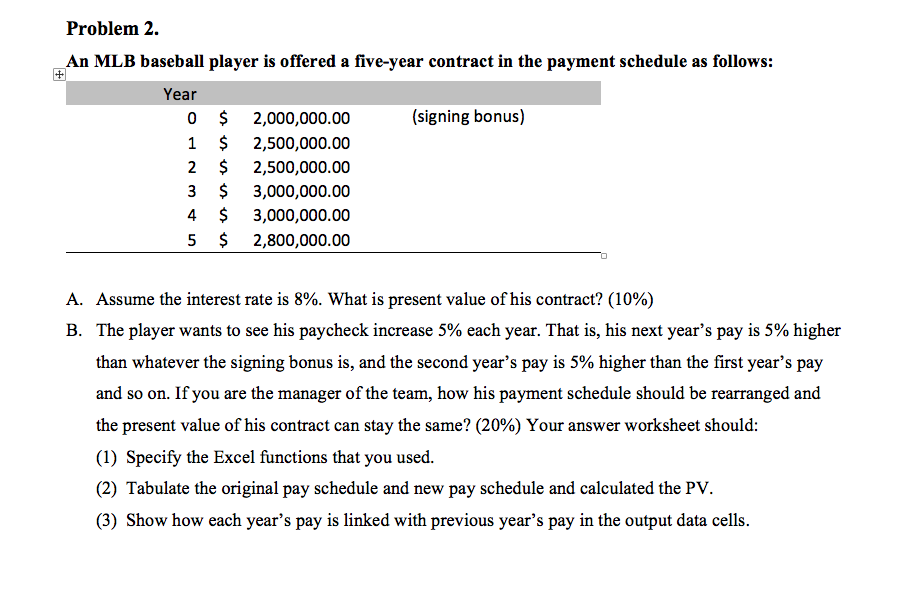

Question: Problem 2. An MLB baseball player is offered a five-year contract in the payment schedule as follows: (signing bonus) Year 0 1 2 3 4

Problem 2. An MLB baseball player is offered a five-year contract in the payment schedule as follows: (signing bonus) Year 0 1 2 3 4 5 $ $ $ $ $ $ 2,000,000.00 2,500,000.00 2,500,000.00 3,000,000.00 3,000,000.00 2,800,000.00 A. Assume the interest rate is 8%. What is present value of his contract? (10%) B. The player wants to see his paycheck increase 5% each year. That is, his next year's pay is 5% higher than whatever the signing bonus is, and the second year's pay is 5% higher than the first year's pay and so on. If you are the manager of the team, how his payment schedule should be rearranged and the present value of his contract can stay the same? (20%) Your answer worksheet should: (1) Specify the Excel functions that you used. (2) Tabulate the original pay schedule and new pay schedule and calculated the PV. (3) Show how each year's pay is linked with previous year's pay in the output data cells. Problem 2. An MLB baseball player is offered a five-year contract in the payment schedule as follows: (signing bonus) Year 0 1 2 3 4 5 $ $ $ $ $ $ 2,000,000.00 2,500,000.00 2,500,000.00 3,000,000.00 3,000,000.00 2,800,000.00 A. Assume the interest rate is 8%. What is present value of his contract? (10%) B. The player wants to see his paycheck increase 5% each year. That is, his next year's pay is 5% higher than whatever the signing bonus is, and the second year's pay is 5% higher than the first year's pay and so on. If you are the manager of the team, how his payment schedule should be rearranged and the present value of his contract can stay the same? (20%) Your answer worksheet should: (1) Specify the Excel functions that you used. (2) Tabulate the original pay schedule and new pay schedule and calculated the PV. (3) Show how each year's pay is linked with previous year's pay in the output data cells

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts