Question: Problem 2 Asset Substitution Problem Coby Corp. (Coby) shareholders, many of whom are also managers, face a dilemma. Their existing strategy of widget production implies

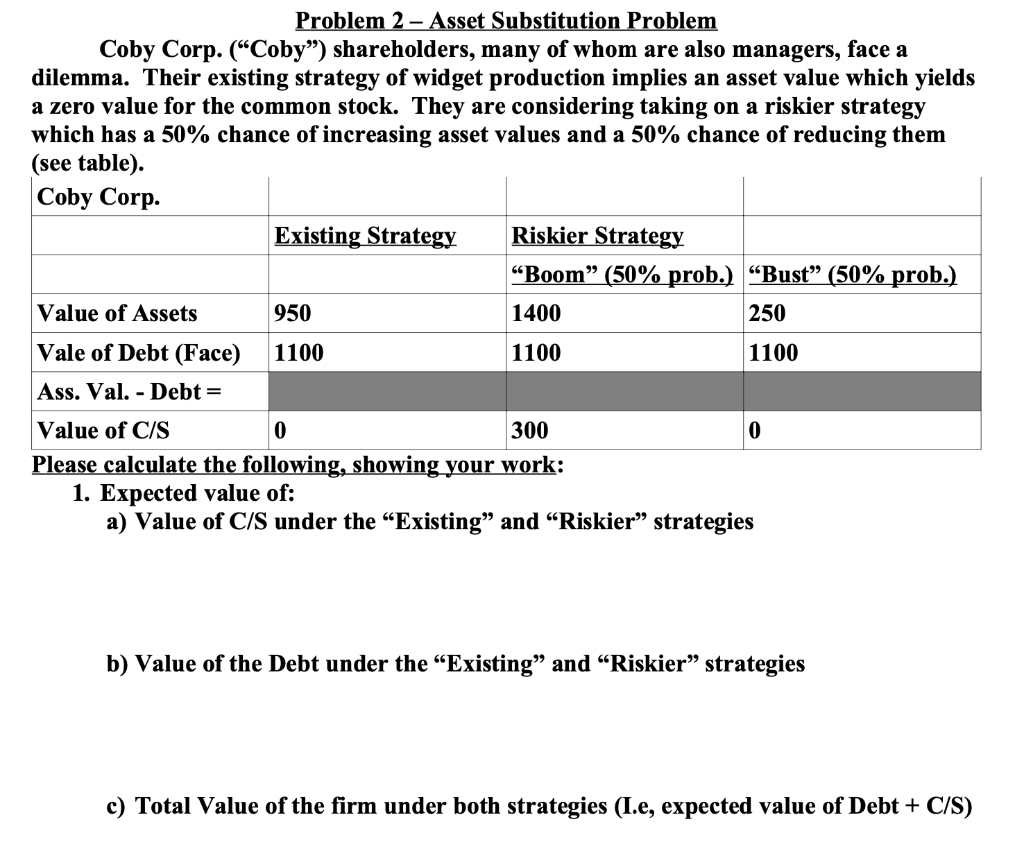

Problem 2 Asset Substitution Problem Coby Corp. (Coby) shareholders, many of whom are also managers, face a dilemma. Their existing strategy of widget production implies an asset value which yields a zero value for the common stock. They are considering taking on a riskier strategy which has a 50% chance of increasing asset values and a 50% chance of reducing them (see table). Coby Corp. Existing Strategy Riskier Strategy Boom (50% prob.) Bust (50% prob.) Value of Assets 950 1400 250 Vale of Debt (Face) 1100 1100 1100 Ass. Val. - Debt = Value of C/S 0 300 0 Please calculate the following, showing your work: 1. Expected value of: a) Value of C/S under the Existing and Riskier strategies b) Value of the Debt under the Existing and Riskier strategies c) Total Value of the firm under both strategies (I.e, expected value of Debt + C/S) Problem 2 Asset Substitution Problem Coby Corp. (Coby) shareholders, many of whom are also managers, face a dilemma. Their existing strategy of widget production implies an asset value which yields a zero value for the common stock. They are considering taking on a riskier strategy which has a 50% chance of increasing asset values and a 50% chance of reducing them (see table). Coby Corp. Existing Strategy Riskier Strategy Boom (50% prob.) Bust (50% prob.) Value of Assets 950 1400 250 Vale of Debt (Face) 1100 1100 1100 Ass. Val. - Debt = Value of C/S 0 300 0 Please calculate the following, showing your work: 1. Expected value of: a) Value of C/S under the Existing and Riskier strategies b) Value of the Debt under the Existing and Riskier strategies c) Total Value of the firm under both strategies (I.e, expected value of Debt + C/S)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts