Question: Problem 2. (Based on C2 on page 56). (15 points) The dataset in CEOSAL_Assgn1.dta (Stata format) contains information on CEOs for US corporations. The variable

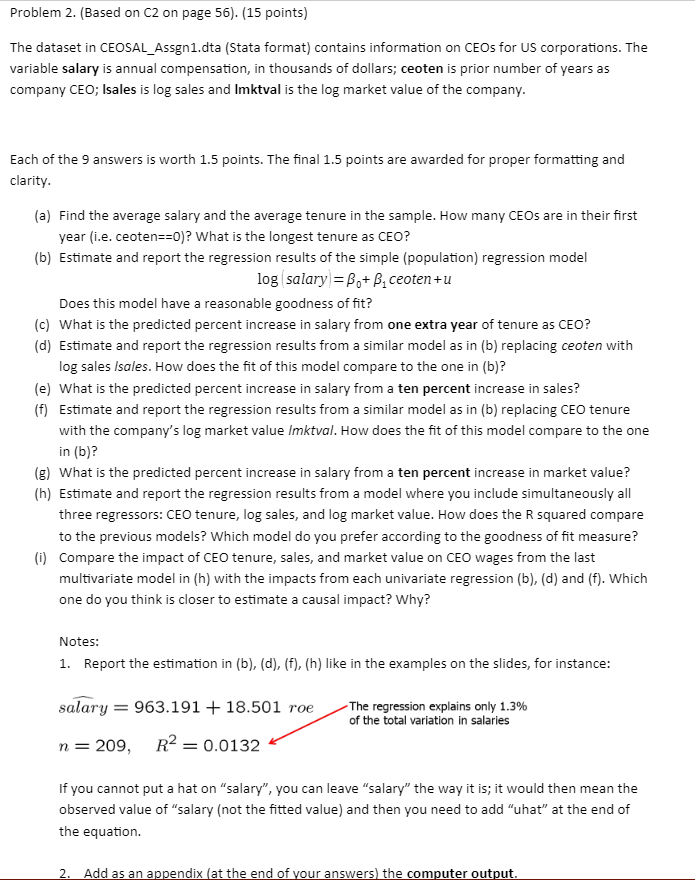

Problem 2. (Based on C2 on page 56). (15 points) The dataset in CEOSAL_Assgn1.dta (Stata format) contains information on CEOs for US corporations. The variable salary is annual compensation, in thousands of dollars; ceoten is prior number of years as company CEO; Isales is log sales and Imktval is the log market value of the company. Each of the 9 answers is worth 1.5 points. The final 1.5 points are awarded for proper formatting and clarity. (a) Find the average salary and the average tenure in the sample. How many CEOs are in their first year (i.e. ceoten==0)? What is the longest tenure as CEO? (b) Estimate and report the regression results of the simple (population) regression model log salary)=Bot B, ceoten+u Does this model have a reasonable goodness of fit? (c) What is the predicted percent increase in salary from one extra year of tenure as CEO? (d) Estimate and report the regression results from a similar model as in (b) replacing ceoten with log sales Isales. How does the fit of this model compare to the one in (b)? (e) What is the predicted percent increase in salary from a ten percent increase in sales? (f) Estimate and report the regression results from a similar model as in (b) replacing CEO tenure with the company's log market value Imktval. How does the fit of this model compare to the one in (b)? (g) What is the predicted percent increase in salary from a ten percent increase in market value? (h) Estimate and report the regression results from a model where you include simultaneously all three regressors: CEO tenure, log sales, and log market value. How does the Rsquared compare to the previous models? Which model do you prefer according to the goodness of fit measure? (i) Compare the impact of CEO tenure, sales, and market value on CEO wages from the last multivariate model in (h) with the impacts from each univariate regression (b), (d) and (f). Which one do you think is closer to estimate a causal impact? Why? Notes: 1. Report the estimation in (b), (d), (f), (h) like in the examples on the slides, for instance: salary = 963.191 + 18.501 roe The regression explains only 1.3% of the total variation in salaries n= 209, R2 = 0.0132 If you cannot put a hat on "salary", you can leave "salary" the way it is; it would then mean the observed value of "salary (not the fitted value) and then you need to add "uhat" at the end of the equation. 2. Add as an appendix (at the end of your answers, the computer output. Problem 2. (Based on C2 on page 56). (15 points) The dataset in CEOSAL_Assgn1.dta (Stata format) contains information on CEOs for US corporations. The variable salary is annual compensation, in thousands of dollars; ceoten is prior number of years as company CEO; Isales is log sales and Imktval is the log market value of the company. Each of the 9 answers is worth 1.5 points. The final 1.5 points are awarded for proper formatting and clarity. (a) Find the average salary and the average tenure in the sample. How many CEOs are in their first year (i.e. ceoten==0)? What is the longest tenure as CEO? (b) Estimate and report the regression results of the simple (population) regression model log salary)=Bot B, ceoten+u Does this model have a reasonable goodness of fit? (c) What is the predicted percent increase in salary from one extra year of tenure as CEO? (d) Estimate and report the regression results from a similar model as in (b) replacing ceoten with log sales Isales. How does the fit of this model compare to the one in (b)? (e) What is the predicted percent increase in salary from a ten percent increase in sales? (f) Estimate and report the regression results from a similar model as in (b) replacing CEO tenure with the company's log market value Imktval. How does the fit of this model compare to the one in (b)? (g) What is the predicted percent increase in salary from a ten percent increase in market value? (h) Estimate and report the regression results from a model where you include simultaneously all three regressors: CEO tenure, log sales, and log market value. How does the Rsquared compare to the previous models? Which model do you prefer according to the goodness of fit measure? (i) Compare the impact of CEO tenure, sales, and market value on CEO wages from the last multivariate model in (h) with the impacts from each univariate regression (b), (d) and (f). Which one do you think is closer to estimate a causal impact? Why? Notes: 1. Report the estimation in (b), (d), (f), (h) like in the examples on the slides, for instance: salary = 963.191 + 18.501 roe The regression explains only 1.3% of the total variation in salaries n= 209, R2 = 0.0132 If you cannot put a hat on "salary", you can leave "salary" the way it is; it would then mean the observed value of "salary (not the fitted value) and then you need to add "uhat" at the end of the equation. 2. Add as an appendix (at the end of your answers, the computer output

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts