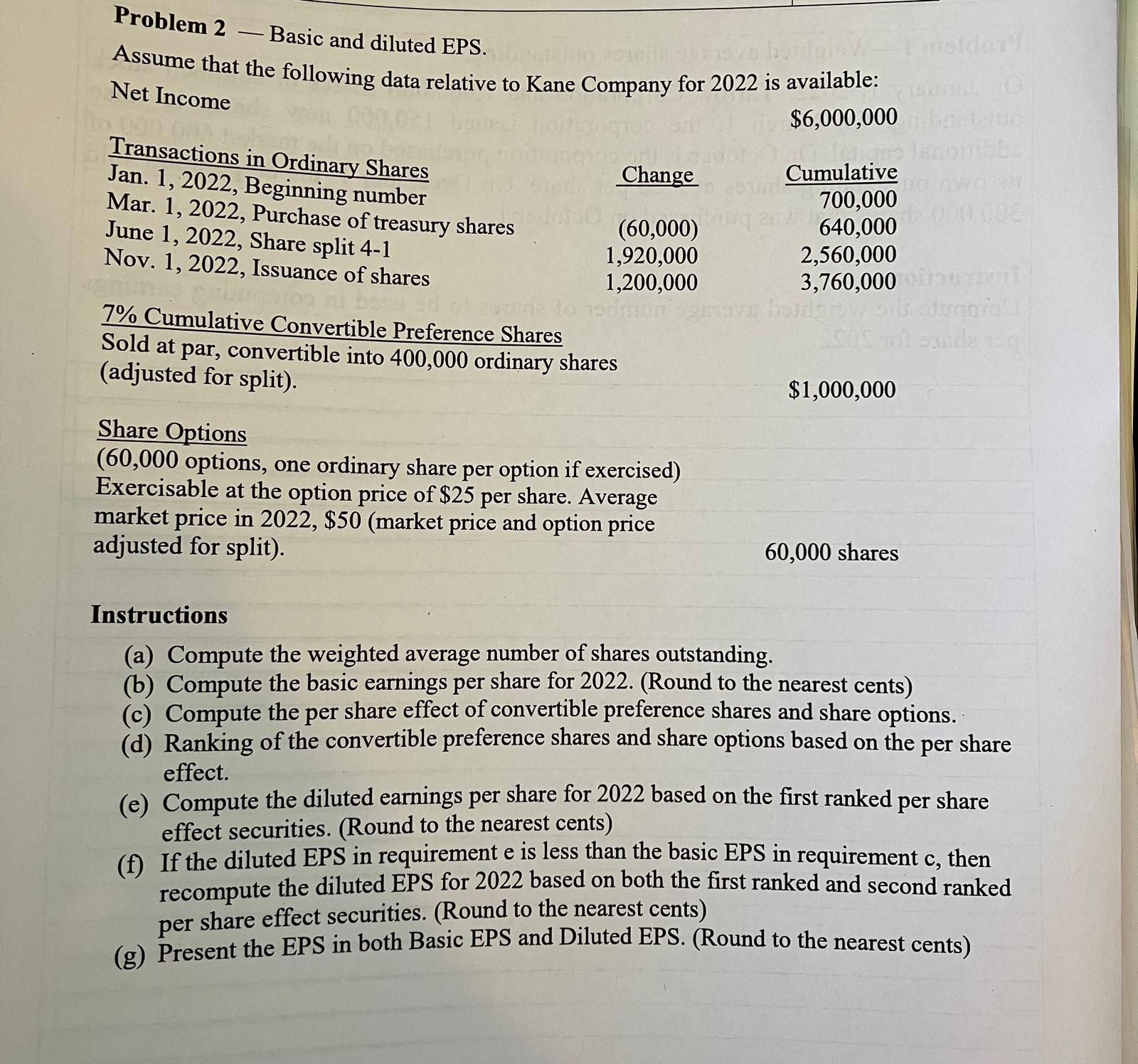

Question: Problem 2 - Basic and diluted EPS. Assume that the following data relative to Kane Company for 2 0 2 2 is available: Net Income

Problem Basic and diluted EPS.

Assume that the following data relative to Kane Company for is available:

Net Income

Transactions in Ordinary Shares

Jan. Beginning number

Mar. Purchase of treasury shares

June Share split

Nov. Issuance of shares

Cumulative Convertible Preference Shares

Sold at par, convertible into ordinary shares

adjusted for split

$

Share Options

options, one ordinary share per option if exercised

Exercisable at the option price of $ per share. Average

market price in $market price and option price

adjusted for split

Instructions

a Compute the weighted average number of shares outstanding.

b Compute the basic earnings per share for Round to the nearest cents

c Compute the per share effect of convertible preference shares and share options.

d Ranking of the convertible preference shares and share options based on the per share

effect.

e Compute the diluted earnings per share for based on the first ranked per share

effect securitiesRound to the nearest cents

f If the diluted EPS in requirement is less than the basic EPS in requirement c then

recompute the diluted EPS for based on both the first ranked and second ranked

per share effect securitiesRound to the nearest cents

g Present the EPS in both Basic EPS and Diluted EPS. Round to the nearest cents

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock