Question: Problem 2 Bookmark this page Problem 2 O points possible tungrade) Construct a portfolio consisting of risk free bonds, European call and put options to

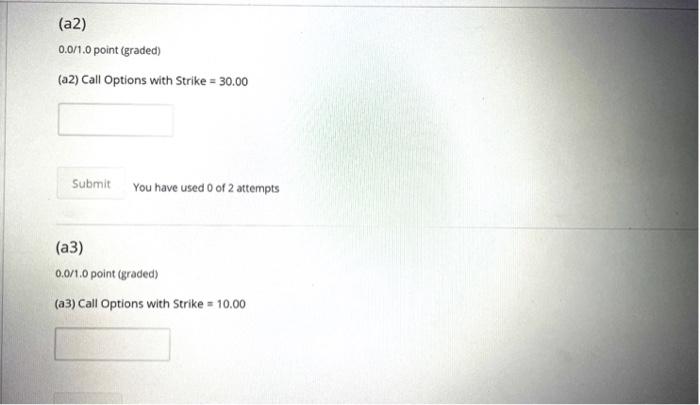

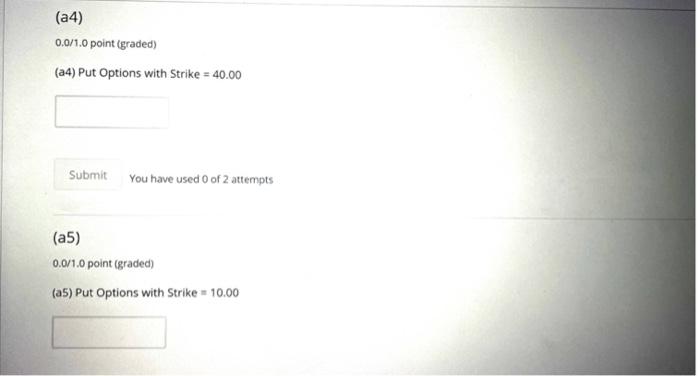

Problem 2 Bookmark this page Problem 2 O points possible tungrade) Construct a portfolio consisting of risk free bonds, European call and put options to replicate the payoff function X (S) below. Be specific about how many options of each type are in your portfolio Use + sign if you buy option and sign if you short it. Use if you do not use an option Save Submit Problem 2 (a) 0 points possible (ungraded) (a) $1.00 x S-40.00, SE (0,40.00) X(S) 40.00 - 1.00 x S. SE (40.00,00) Enter number of the options you will use with the given characteristics if bonds are not available. Submit (a1) 0.0/1.0 point (graded (al) Call Options with Strike = 40.00 (a2) 0.0/1.0 point (graded) (a2) Call Options with Strike = 30.00 Submit You have used 0 of 2 attempts (a3) 0.0/1.0 point (graded) (a3) Call Options with Strike = 10.00 (24) 0.0/1.0 point (graded) (24) Put Options with Strike = 40.00 Submit You have used 0 of 2 attempts (a5) 0.0/1.0 point (graded) (a5) Put Options with Strike = 10.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts