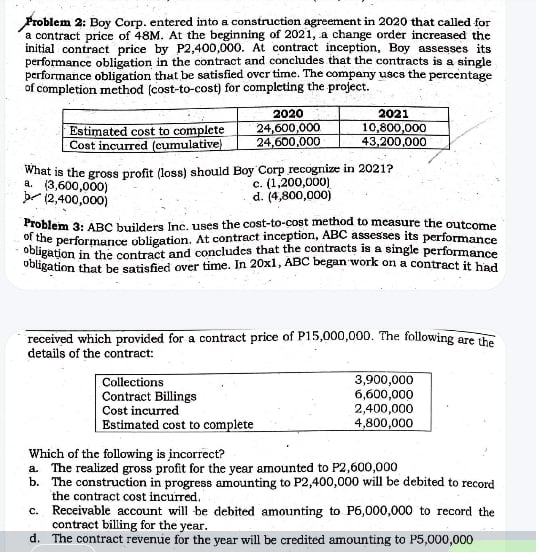

Question: Problem 2 : Boy Corp. entered into a construction agreement in 2 0 2 0 that called for a contract price of 4 8 M

Problem : Boy Corp. entered into a construction agreement in that called for

a contract price of M At the beginning of a change order increased the

initial contract price by P At contract inception, Boy assesses its

performance obligation in the contract and concludes that the contracts is a single

performance obligation that be satisfied over time. The company uscs the percentage

of completion method costtocost for completing the project.

What is the gross profit loss should Boy Corp recognize in

a

c

b

d

Problem : ABC builders Inc. uses the costtocost method to measure the outcome

of the performance obligation. At contract inception, ABC assesses its performance

obligation in the contract and concludes that the contracts is a single performance

obligation that be satisfied over time. In ABC began work on a contract it had

received which provided for a contract price of P The following are the

details of the contract:

Which of the following is incorrect?

a The realized gross profit for the year amounted to P

b The construction in progress amounting to P will be debited to record

the contract cost incurred.

c Receivable account will be debited amounting to to record the

contract billing for the year.

d The contract revenue for the year will be credited amounting to P

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock