Question: Problem 2: Cash Flow Models (4 points) a) (2 points) The firm pays dividends of $100 annually in years 1-10 and of $250 annually in

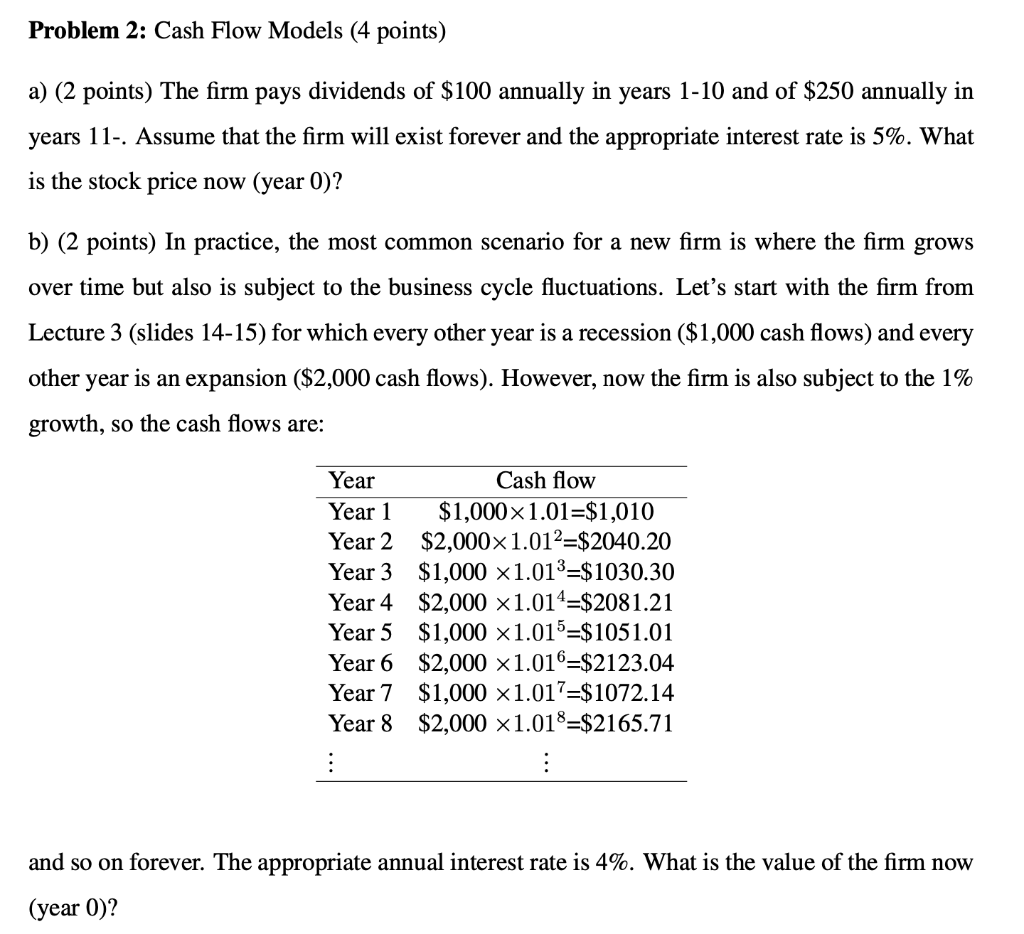

Problem 2: Cash Flow Models (4 points) a) (2 points) The firm pays dividends of $100 annually in years 1-10 and of $250 annually in years 11-. Assume that the firm will exist forever and the appropriate interest rate is 5%. What is the stock price now (year 0)? b) (2 points) In practice, the most common scenario for a new firm is where the firm grows over time but also is subject to the business cycle fluctuations. Let's start with the firm from Lecture 3 (slides 14-15) for which every other year is a recession ($1,000 cash flows) and every other year is an expansion ($2,000 cash flows). However, now the firm is also subject to the 1% growth, so the cash flows are: Year Cash flow Year 1 $1,000 x 1.01=$1,010 Year 2 $2,000x1.012=$2040.20 Year 3 $1,000 x1.01?=$1030.30 Year 4 $2,000 x1.014=$2081.21 Year 5 $1,000 x1.01$=$1051.01 Year 6 $2,000 x1.016=$2123.04 Year 7 $1,000 x1.01?=$1072.14 Year 8 $2,000 x1.018=$2165.71 : and so on forever. The appropriate annual interest rate is 4%. What is the value of the firm now (year 0)? Problem 2: Cash Flow Models (4 points) a) (2 points) The firm pays dividends of $100 annually in years 1-10 and of $250 annually in years 11-. Assume that the firm will exist forever and the appropriate interest rate is 5%. What is the stock price now (year 0)? b) (2 points) In practice, the most common scenario for a new firm is where the firm grows over time but also is subject to the business cycle fluctuations. Let's start with the firm from Lecture 3 (slides 14-15) for which every other year is a recession ($1,000 cash flows) and every other year is an expansion ($2,000 cash flows). However, now the firm is also subject to the 1% growth, so the cash flows are: Year Cash flow Year 1 $1,000 x 1.01=$1,010 Year 2 $2,000x1.012=$2040.20 Year 3 $1,000 x1.01?=$1030.30 Year 4 $2,000 x1.014=$2081.21 Year 5 $1,000 x1.01$=$1051.01 Year 6 $2,000 x1.016=$2123.04 Year 7 $1,000 x1.01?=$1072.14 Year 8 $2,000 x1.018=$2165.71 : and so on forever. The appropriate annual interest rate is 4%. What is the value of the firm now (year 0)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts