Question: Problem 2. Consider a 3-state market model over a single period of one year Where (2 = {U, N, D}. Here U=Upward movement, N=No change

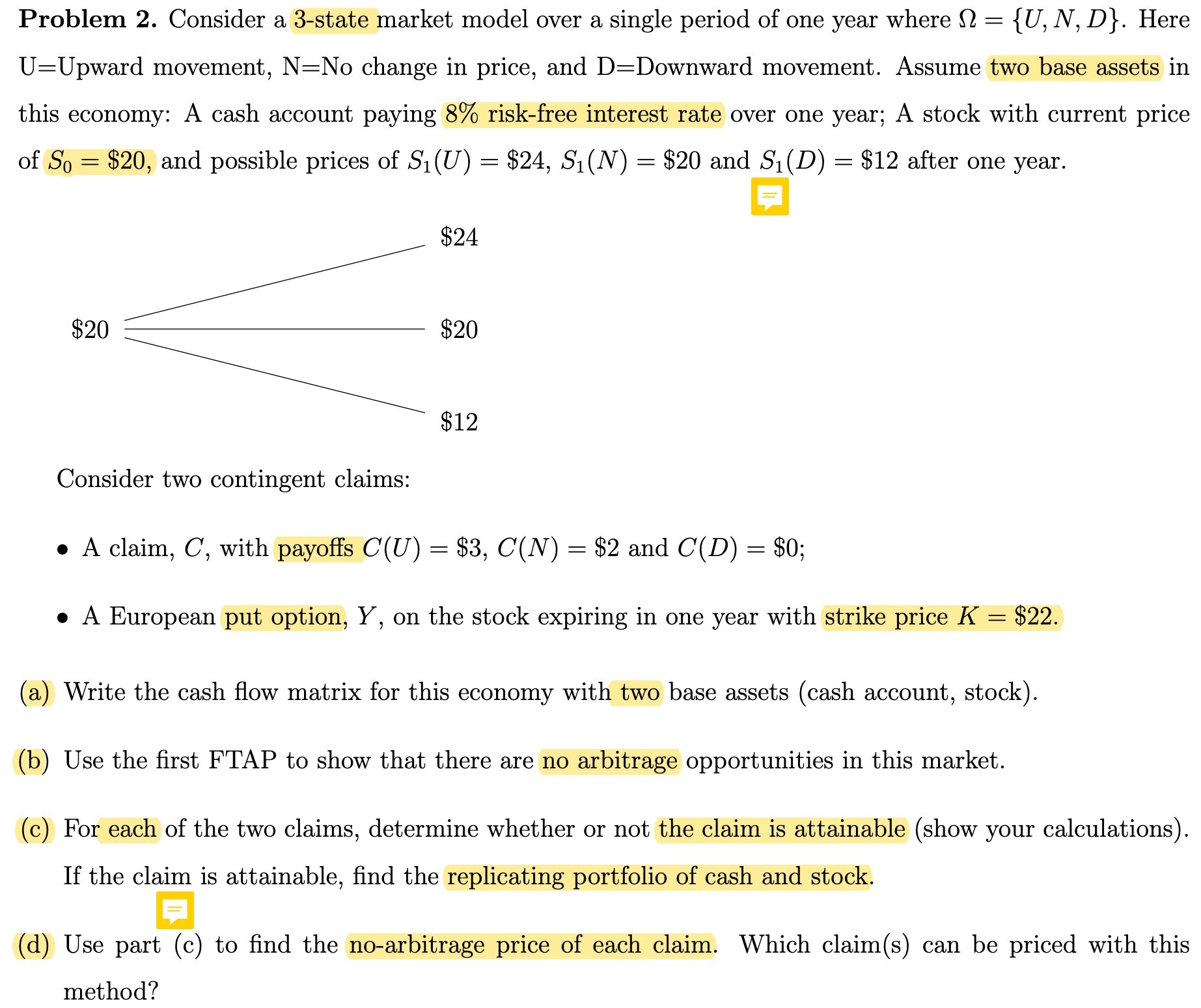

Problem 2. Consider a 3-state market model over a single period of one year Where (2 = {U, N, D}. Here U=Upward movement, N=No change in price, and D=Downward movement. Assume two base assets in this economy: A cash account paying 8% risk-free interest rate over one year; A stock with current price of So = $20, and possible prices of 31(U) = $24, 81(N) = $20 and 81 (D) = $12 after one year. / $24 $12 Consider two contingent claims: 0 A claim, 0, with payoffs C(U) = $3, C(N) = $2 and C(D) = $0; 0 A European put option, Y, on the stock expiring in one year with strike price K = $22. (a) Write the cash ow matrix for this economy with two base assets (cash account, stock). (b) Use the rst FTAP to ShOW that there are no arbitrage opportunities in this market. (0) For each of the two claims, determine Whether or not the claim is attainable (Show your calculations). If the claim is attainable, nd the replicating portfolio of cash and stock. ((1) Use part (c) to nd the noarbitrage price of each claim. Which c1aim(s) can be priced with this method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts