Question: = Problem 2. Consider a European put option on a stock S with current price So = 50. The maturity of the option is one

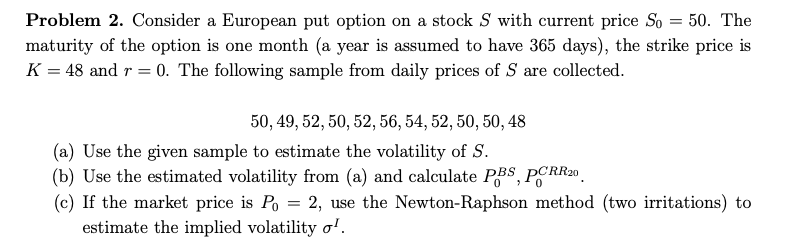

= Problem 2. Consider a European put option on a stock S with current price So = 50. The maturity of the option is one month (a year is assumed to have 365 days), the strike price is K = 48 and r = 0. The following sample from daily prices of S are collected. 50, 49, 52, 50, 52, 56, 54, 52, 50, 50, 48 (a) Use the given sample to estimate the volatility of S. (b) Use the estimated volatility from (a) and calculate PBS, PCRR20. (c) If the market price is Po = 2, use the Newton-Raphson method (two irritations) to estimate the implied volatility oh. ? = Problem 2. Consider a European put option on a stock S with current price So = 50. The maturity of the option is one month (a year is assumed to have 365 days), the strike price is K = 48 and r = 0. The following sample from daily prices of S are collected. 50, 49, 52, 50, 52, 56, 54, 52, 50, 50, 48 (a) Use the given sample to estimate the volatility of S. (b) Use the estimated volatility from (a) and calculate PBS, PCRR20. (c) If the market price is Po = 2, use the Newton-Raphson method (two irritations) to estimate the implied volatility oh

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts