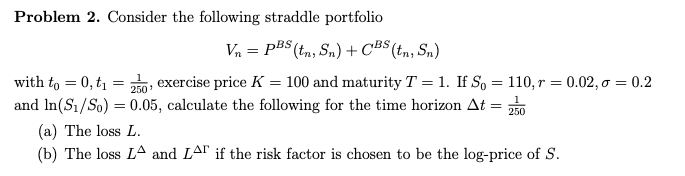

Question: Problem 2. Consider the following straddle portfolio Vn = pBS (tr, Sn) + CBS(tn, Sn) with to = 0, t = 250, exercise price K

Problem 2. Consider the following straddle portfolio Vn = pBS (tr, Sn) + CBS(tn, Sn) with to = 0, t = 250, exercise price K = 100 and maturity T = 1. If So = 110, r = 0.02, 0 = 0.2 and In(S./S) = 0.05, calculate the following for the time horizon At = 250 (a) The loss L. (b) The loss LA and LAT if the risk factor is chosen to be the log-price of S. Problem 2. Consider the following straddle portfolio Vn = pBS (tr, Sn) + CBS(tn, Sn) with to = 0, t = 250, exercise price K = 100 and maturity T = 1. If So = 110, r = 0.02, 0 = 0.2 and In(S./S) = 0.05, calculate the following for the time horizon At = 250 (a) The loss L. (b) The loss LA and LAT if the risk factor is chosen to be the log-price of S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts