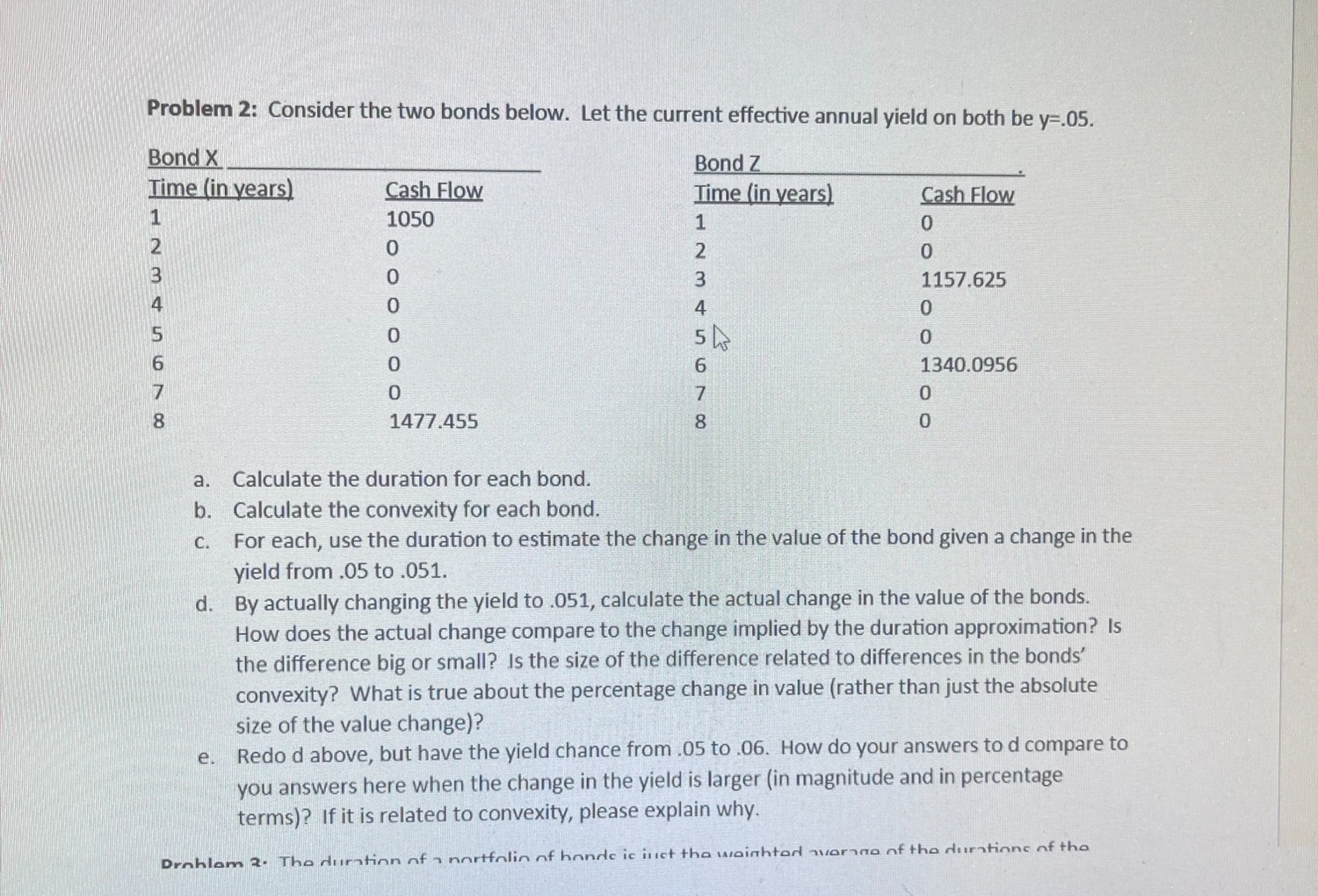

Question: Problem 2 : Consider the two bonds below. Let the current effective annual yield on both be y = . 0 5 . a .

Problem : Consider the two bonds below. Let the current effective annual yield on both be

a Calculate the duration for each bond.

b Calculate the convexity for each bond.

c For each, use the duration to estimate the change in the value of the bond given a change in the

yield from to

d By actually changing the yield to calculate the actual change in the value of the bonds.

How does the actual change compare to the change implied by the duration approximation? Is

the difference big or small? Is the size of the difference related to differences in the bonds'

convexity? What is true about the percentage change in value rather than just the absolute

size of the value change

e Redo d above, but have the yield chance from to How do your answers to d compare to

you answers here when the change in the yield is larger in magnitude and in percentage

terms If it is related to convexity, please explain why.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock