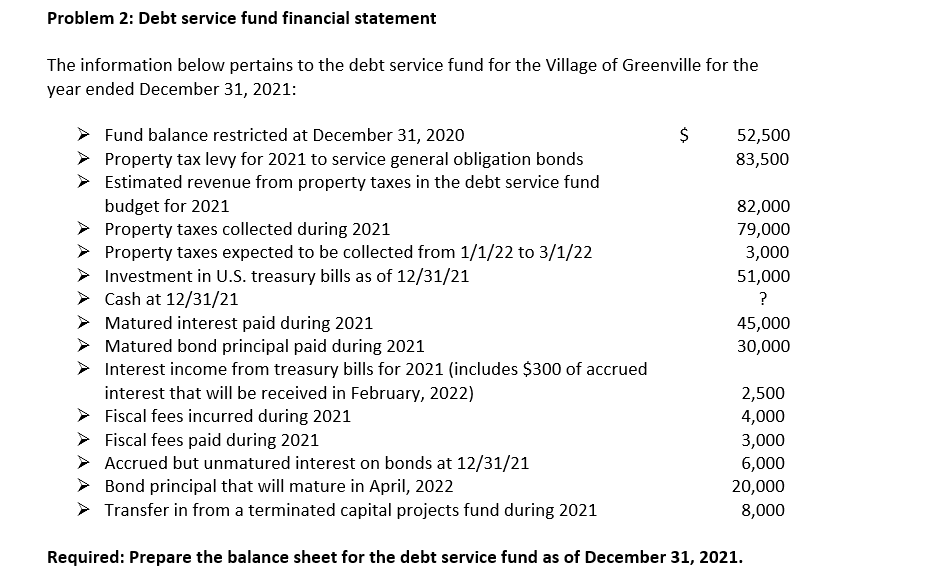

Question: Problem 2: Debt service fund financial statement The information below pertains to the debt service fund for the Village of Greenville for the year ended

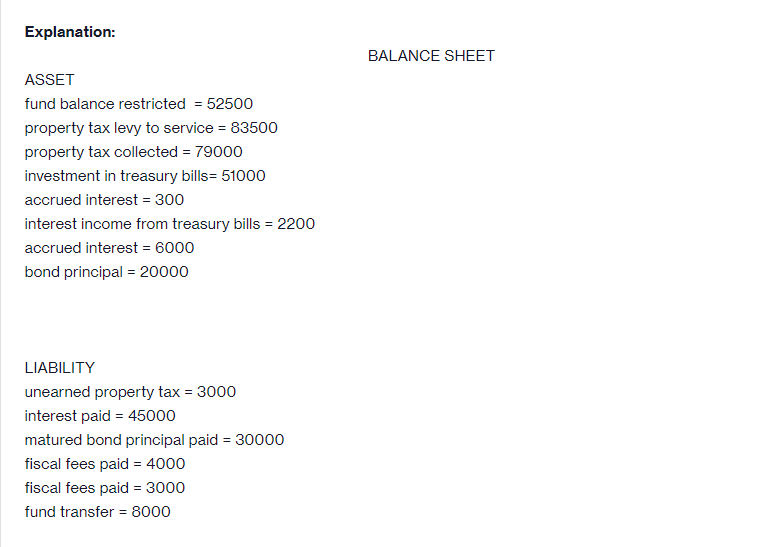

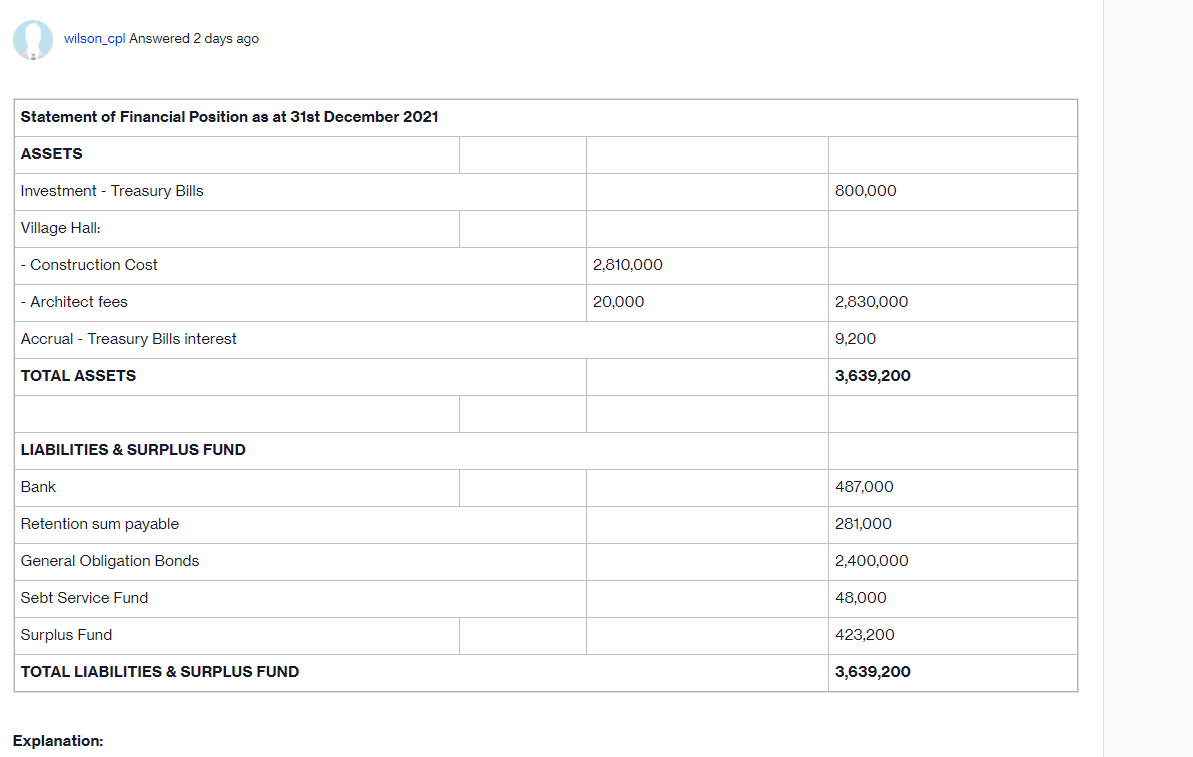

Problem 2: Debt service fund financial statement The information below pertains to the debt service fund for the Village of Greenville for the year ended December 31, 2021: 5*- 5*- >- VVVVVVV VVVVV Fund balance restricted at December 31, 2020 Property tax levy for 2021 to service general obligation bonds Estimated revenue from property taxes in the debt service fund budget for 2021 Property taxes collected during 2021 Property taxes expected to be collected from 1f1l22 to 3l1f22 Investment in U.S. treasury bills as of 12f31/21 lCash at 12f31/21 Matured interest paid during 2021 Matured bond principal paid during 2021 Interest income from treasury bills for 2021 (includes 5300 of accrued interest that will be received in February, 2022) Fiscal fees incurred during 2021 Fiscal fees paid during 2021 Accrued but unmatured interest on bonds at 12f31/21 Bond principal that will mature in April, 2022 Transfer in from a terminated capital projects fund during 2021 52,500 33,500 32,000 79,000 3,000 51,000 ? 45,000 30,000 2,500 4,000 3,000 3,000 20,000 3,000 Required: Prepare the balance sheet for the debt service fund as of December 31, 2021. Problem 2:Explanation: BALANCE SHEET ASSET fund balance restricted = 52500 property tax levy to service = 83500 property tax collected = 79000 investment in treasury bills= 51000 accrued interest = 300 interest income from treasury bills = 2200 accrued interest = 6000 bond principal = 20000 LIABILITY unearned property tax = 3000 interest paid = 45000 matured bond principal paid = 30000 fiscal fees paid = 4000 fiscal fees paid = 3000 fund transfer = 8000wilson_cpl Answered 2 days ago Statement of Financial Position as at 31st December 2021 ASSETS Investment Treasury Bills 800,000 Village Hall: Construction Cost 2,810,000 Architect fees 20,000 2,830,000 Accrual Treasury Bills interest 9,200 TOTAL ASSETS 3,639,200 LIABILITIES & SURPLUS FUND Bank 48?,000 Retention sum payable 281,000 General Obligation Bonds 2,400,000 Sebt Service Fund 48,000 Surplus Fund 423,200 TOTAL LIABILITIES & SURPLUS FUND 3,639,200 Explanation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts