Question: Problem 2 Doggery Doge, Inc. exchanged equipment for a building. The book value and fair value of the equipment were $200,000 and $215,000, respectively. The

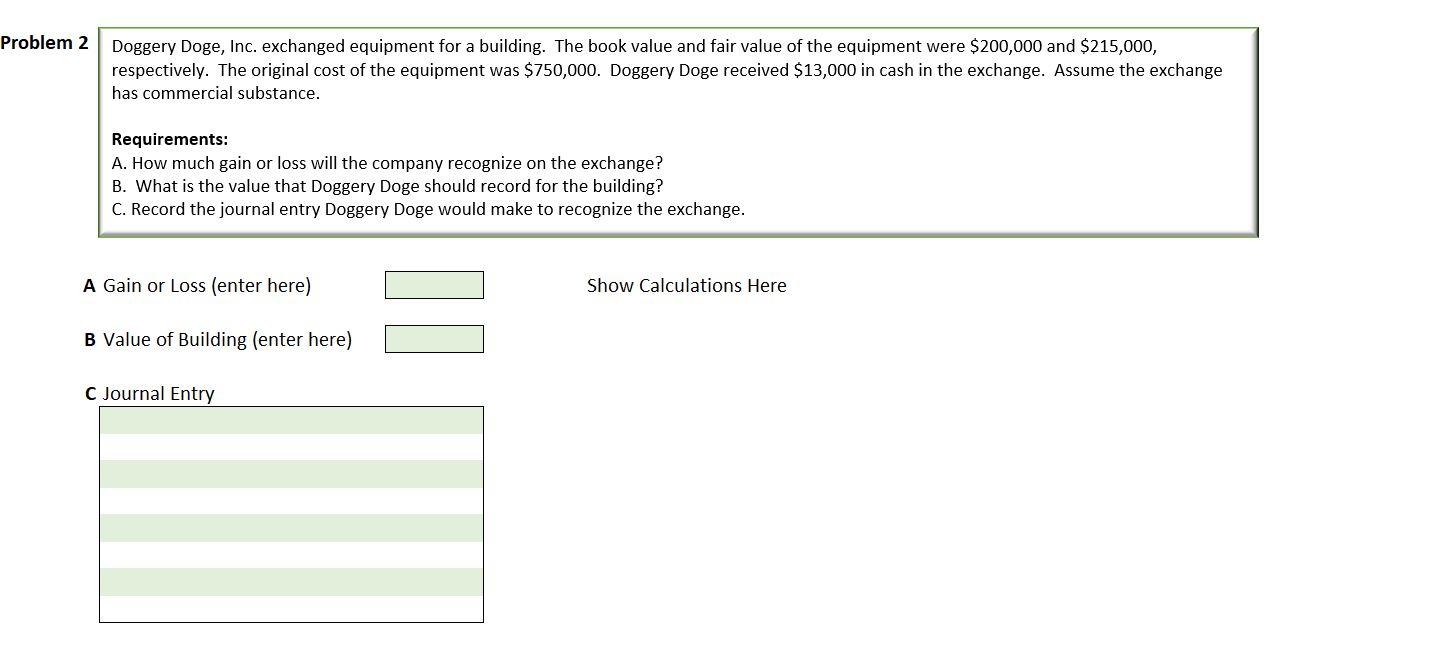

Problem 2 Doggery Doge, Inc. exchanged equipment for a building. The book value and fair value of the equipment were $200,000 and $215,000, respectively. The original cost of the equipment was $750,000. Doggery Doge received $13,000 in cash in the exchange. Assume the exchange has commercial substance. Requirements: A. How much gain or loss will the company recognize on the exchange? B. What is the value that Doggery Doge should record for the building? C. Record the journal entry Doggery Doge would make to recognize the exchange. A Gain or Loss (enter here) Show Calculations Here B Value of Building (enter here) C Journal Entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts