Question: Problem 2 Duke, Inc. purchased a new machine on January 1, 2011, at a cost of $950,000. The machine's estimated useful life at the time

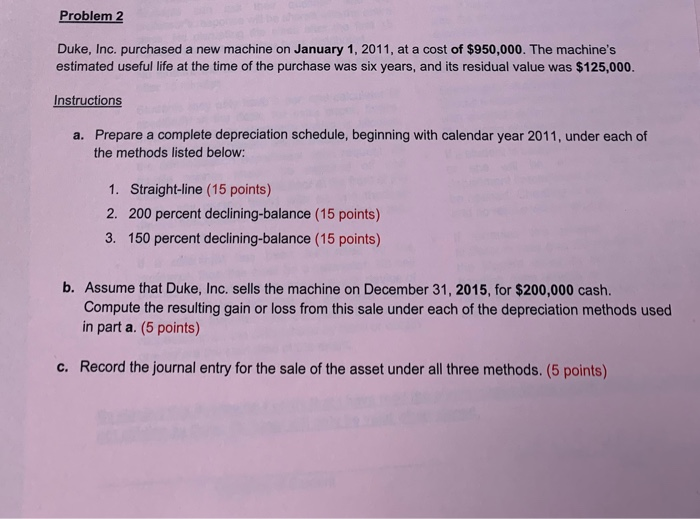

Problem 2 Duke, Inc. purchased a new machine on January 1, 2011, at a cost of $950,000. The machine's estimated useful life at the time of the purchase was six years, and its residual value was $125,000. Instructions a. Prepare a complete depreciation schedule, beginning with calendar year 2011, under each of the methods listed below: 1. Straight-line (15 points) 2. 200 percent declining-balance (15 points) 3. 150 percent declining-balance (15 points) b. Assume that Duke, Inc. sells the machine on December 31, 2015, for $200,000 cash. Compute the resulting gain or loss from this sale under each of the depreciation methods used in part a. (5 points) c. Record the journal entry for the sale of the asset under all three methods. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts