Question: Problem 2 Earnings per share I. (11 points) On December 31, 2015, Baila Company had 100,000 shares of c stock outstanding and 30,000 shares of

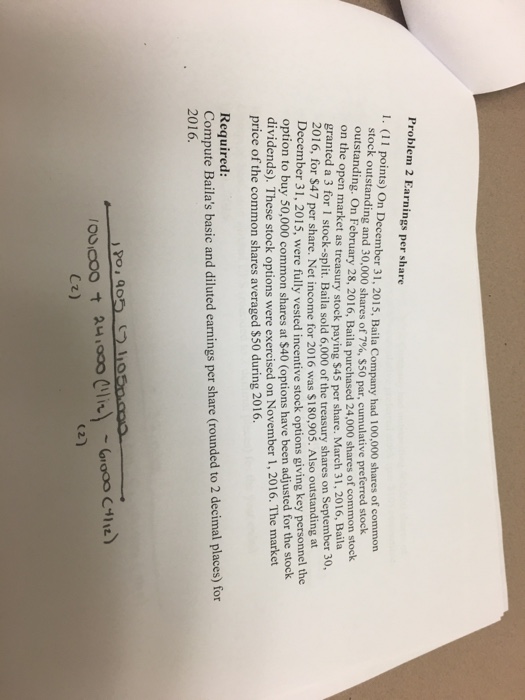

Problem 2 Earnings per share I. (11 points) On December 31, 2015, Baila Company had 100,000 shares of c stock outstanding and 30,000 shares of 7%, $50 par, cumulative preferred outstanding. On February 28, 2016, Baila purchased 24,000 shares of common stock on the open market as treasury stock paying $45 per share. March 31, 2016, Baila granted a 3 for 1 stock-split. Baila sold 6,000 of the treasury shares on September 30 2016, for $47 per share. Net income for 2016 was $180,905. Also outstanding at December 31, 2015, were fully vested incentive stock options giving key personnel the option to buy 50,000 common shares at $40 (options have been adjusted for the stock stock dividends). These stock options were exercised on November 1,2016. The market price of the common shares averaged $50 during 2016. Required: Compute Baila's basic and diluted earnings per share (rounded to 2 2016 24.000 Cllie) -6,ooo C.thz) oo.coo Cz)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts