Question: Problem #2: Efficient Market Hypothesis (10 points) Recall the three forms of market efficiency. Which of the following observations appear to indicate market inefficiency? Further,

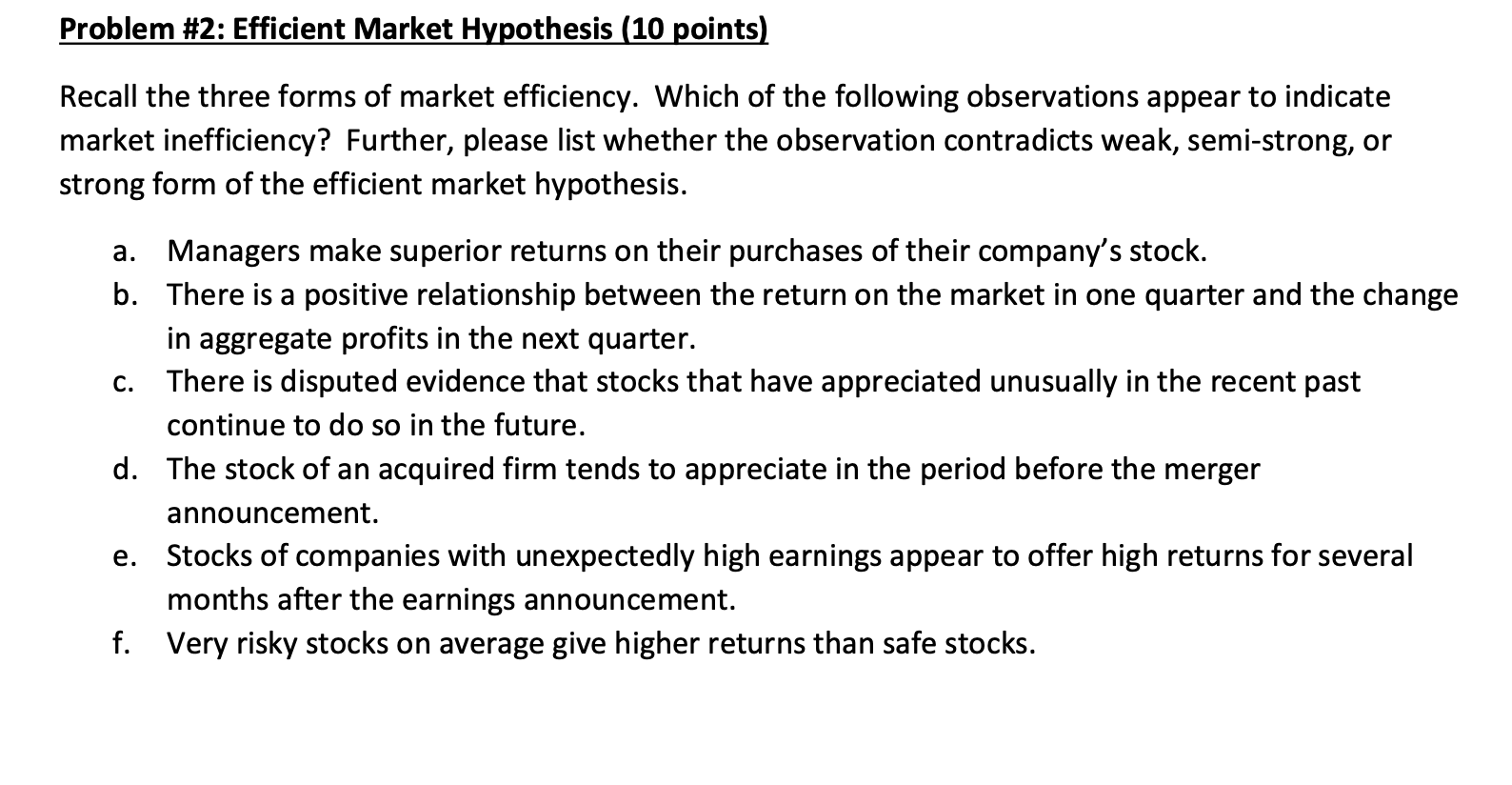

Problem #2: Efficient Market Hypothesis (10 points) Recall the three forms of market efficiency. Which of the following observations appear to indicate market inefficiency? Further, please list whether the observation contradicts weak, semi-strong, or strong form of the efficient market hypothesis. a. Managers make superior returns on their purchases of their company's stock. b. There is a positive relationship between the return on the market in one quarter and the change in aggregate profits in the next quarter. C. There is disputed evidence that stocks that have appreciated unusually in the recent past continue to do so in the future. d. The stock of an acquired firm tends to appreciate in the period before the merger announcement. Stocks of companies with unexpectedly high earnings appear to offer high returns for several months after the earnings announcement. f. Very risky stocks on average give higher returns than safe stocks. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts